Editor’s note: On Tuesday, May 4th the PPP ran out of general funds and the SBA stopped accepting new PPP loan applications. A reserve of funds is still available for community financial institutions that lend to businesses run by women, minorities, and underserved communities. Additionally, a reserve of funds remains for applications previously submitted but not yet reviewed by the SBA. If you have already submitted your loan application, however, this does not guarantee you funding.

Eligibility criteria

If the following statements apply to your business, you are eligible to apply for your second PPP loan in 2021.

- You have used up your first PPP loan

- Your business was operational before February 15, 2020

- Your business is still open and operational

- You have no more than 300 employees

- If your business has multiple locations, you have no more than 300 employees per location

- You can show a 25% or greater reduction in gross revenue

Where should I apply for a PPP 2 loan?

While you can apply for your second PPP loan through any lenders, it’s recommended you apply through your first PPP loan lender. We’ve heard from our lending partners that they will be prioritizing borrowers they’ve worked with before when it comes to approving second draw PPP loans. However, you’re still free to explore other lenders.

Which application should I use to apply?

There are two application forms that can be used to apply for a second PPP loan.

Form 2483-SD is the main form that most businesses will use. Form 2483-SD-C is specifically for self-employed individuals who will be applying for a PPP loan using their gross or net income taken from a Schedule C.

If you are not applying with a Schedule C, read on for more information on form 2483-SD. If you are applying using a Schedule C, jump ahead to our overview of form 2483-SD-C.

Application form 2483-SD explained

We’ll go through the application box by box. We recommend you follow along by downloading a PPP loan application here. Check in with your lender before filling in the application. Some lenders will require you to submit your information through their online portal as opposed to submitting a paper application.

Part 1: Your business information

Business structure

Start by selecting the business structure that best represents your business. Try to be as specific as possible. For example, choosing “Sole Proprietor” is going to be better than “Self-Employed Individual”—as even though both could be correct, one conveys more information.

Business name and address

You are required to provide both your Business Legal Name and your DBA or Tradename if applicable. Your Business Legal Name is found on any government forms. A DBA or Tradename is what appears on bank statements or invoices if it’s different than your Business Legal Name. Your Business Address is also found in these documents.

Year of Establishment (if applicable)

If you are not a self-employed individual or contractor, you will have to provide the year your business was established. This must be consistent with the documents you filed to make the business official.

NAICS code

You can find your NAICS code on a website like NAICS.com. NAICS codes are self-assigned meaning you pick the code that best suits your business rather than having one assigned to you. Start by searching keywords of what you do or look up a similar business’s NAICS code.

Business EIN/TIN/SSN

Your EIN (Employer Identification Number), TIN (Taxpayer Identification Number), or Social Security Number (SSN) is found on previous tax returns. If you’re having trouble finding this info, follow the IRS’s steps to finding your EIN here. Note that an SSN should only be provided if you do not have a business EIN or TIN.

Contact information

Finally, provide the name, business phone, and email address of the primary contact for the application. This will be who all future communications are directed to.

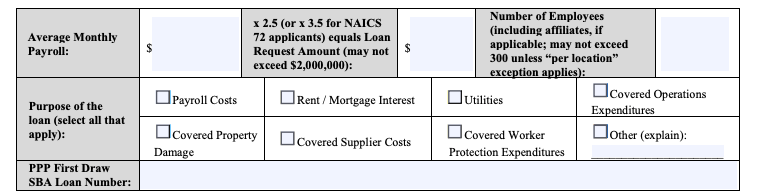

Part 2: Loan amount calculation

Average monthly payroll costs

Your loan amount calculation starts with finding your average monthly payroll costs. Your average monthly payroll costs can be calculated using one of the following:

- the one year period before the loan application

- the calendar year of 2020

- the calendar year of 2019

Once you’ve chosen the time period you want to use, follow these steps:

Step 1: Add up the payroll costs for all employees whose principal place of residence is in the United States. Payroll costs include:

- Salaries, wages, commissions or tips

- Employee benefits including paid leave, allowance for separation or dismissal, and healthcare benefits including insurance premiums and retirement benefits

- State and local taxes

If you are including your net or gross income as reported on a Schedule C, use form 2483-SD-C.

Step 2: Subtract any compensation paid to an employee in excess of $100,000. For example, if you have two employees earning $120,000 over the year, subtract $40,000 from your payroll total.

Step 3: Divide the total amount from Step 2 by 12 and put it in the Average Monthly Payroll box.

Loan request amount

Once you have your average monthly payroll costs, finding your loan amount is as easy as multiplying it by 2.5 or 3.5.

Most businesses will use 2.5, the same calculation used in 2020.

But for businesses in the food and accommodation industry, you are eligible for 3.5 times your average monthly payroll costs. You are in the food and accommodation industry if your NAICS code (which you’ve provided already on this application) starts with 72.

Loan amounts are capped at $2 million. Put the lesser of your calculated loan amount and $2 million dollars in your loan request amount box.

Number of employees

Add up all employees across all locations and affiliates. There are three main cases where your business and another business would be considered affiliates:

- If your business controls or has the power to control another business

- If another business controls or has the power to control your business

- If a third party controls your business and another business

You can review the full affiliation rules the SBA provided here.

The purpose of the loan

Check all boxes that apply. Businesses that do not run payroll but are still eligible for a PPP loan should check “Payroll Costs.” Self-employed individuals are eligible to take the PPP to cover your self-employment income. This is called owner compensation replacement or OCR and is still considered a payroll cost.

The purpose of PPP loans is to protect paychecks. If you do not select “Payroll Costs” in this section, your application may be denied.

PPP First Draw SBA Loan Number

The PPP loan you received in 2020 is considered your first draw PPP loan. You can find this number on the loan offer you received.

If you cannot find your loan offer, reach out to your previous lender. Most lenders will have this information available in an online portal you can access.

Part 3: Reduction in gross receipts

A new eligibility requirement for second draw PPP loans is showing you experienced a 25% reduction in gross receipts.

For loan amounts of $150,000 or less, this section can be left blank. However, you will be asked to provide this information either when you apply for forgiveness, or beforehand.

To calculate the reduction in gross receipts,you can use:

- Any quarter in 2020 and compare it with the same quarter in 2019

- Compare your annual 2020 and 2019 gross receipts

If you choose to use annual numbers, put “Annual” in the 2020 quarter and reference quarter boxes.

If your business opened in 2020 but was operational on February 15, 2020, you must use Q1 2020 as the reference quarter. The 25% reduction in revenue must be shown by comparing either Q2, Q3, or Q4 2020 with Q1 2020.

Further reading: How to Calculate a 25% Reduction in Revenue for PPP 2

Part 4: Applicant Ownership

List all members of the ownership that hold 20% or more of the business. If you have more owners than spaces on the application, attach them as a separate sheet.

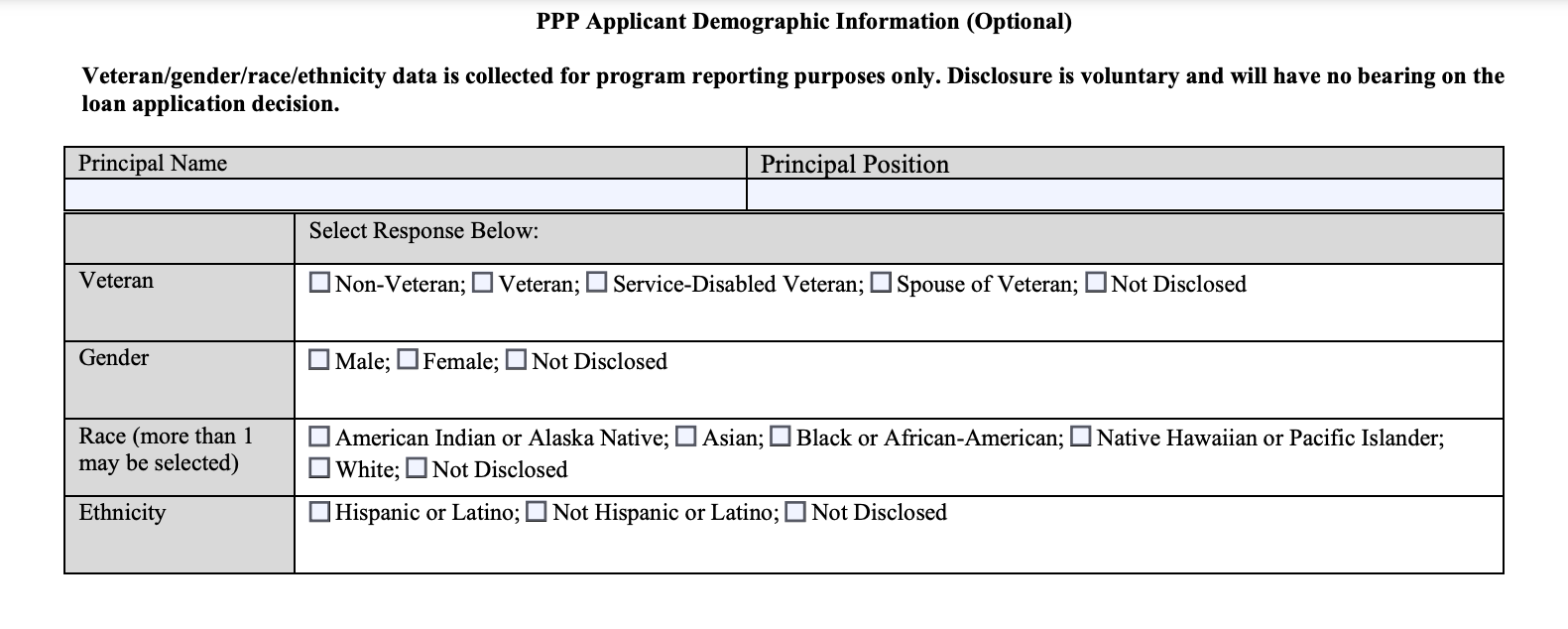

Part 5: Applicant Demographic Information (Optional)

This section is completely voluntary and will be used for reporting purposes only. Any information you provide here will not impact your loan application.

Part 6: Questionnaire

Answer each question and initial where indicated. Answering yes to questions 1, 2, 4, or 5 will mean you are ineligible for a PPP loan.

Part 7: Certifying you applied in good faith

On pages three and four of the application form, there are 15 statements. Each must be signed to certify that you are applying in good faith that these statements apply to your business. Be sure to read through each. Signing on any of these statements later found untrue can result in penalties through imprisonment or fines.

Application form 2483-SD-C explained

If you are applying with a Schedule C, apply with form 2483-SD-C. We’ll go through the application form box by box. We recommend you follow along by downloading a PPP loan application here. Check in with your lender before filling in the application. Some lenders will require you to submit your information through their online portal as opposed to submitting a paper application.

Part 1: Your business information

Business structure

Choose the box that best describes your business. For example, if you do contract work on the side or work for a business like Uber, choose Independent Contractor. Or if your business is a full time gig, select Sole Proprietor. If you’re unsure, you can also select Self-employed Individual.

Business name and address

You are required to provide both your Business Legal Name and your DBA or Tradename if applicable. Your Business Legal Name is found on any government forms. A DBA or Tradename is what appears on bank statements or invoices if it’s different than your Business Legal Name. Your Business Address is also found in these documents.

Year of Establishment (if applicable)

Applicants can choose to put N/A or provide the year they started business operations.

NAICS code

You can find your NAICS code on a website like NAICS.com. NAICS codes are self-assigned meaning you pick the code that best suits your business rather than having one assigned to you. Start by searching keywords of what you do or look up a similar business’s NAICS code.

Business EIN/TIN/SSN

Your EIN (Employer Identification Number), TIN (Taxpayer Identification Number), or Social Security Number (SSN) is found on previous tax returns. If you’re having trouble finding this info, follow the IRS’s steps to finding your EIN here. Note that an SSN should only be provided if you do not have a business EIN or TIN.

Contact information

Provide the name, business phone, and email address of the primary contact for the application. This will be who all future communications are directed to.

Total Amount of Gross Income

This can be taken straight from line 7 of your Schedule C. You can use a 2019 or 2020 Schedule C for your application. If you haven’t filed a 2020 Schedule C, you can draft one up for the purpose of applying, but it must be tax ready (meaning complete and ready to file).

Tax Year Used for Gross Income

Select either 2019 or 2020, the same year as the Schedule C you will be using to apply.

Number of Employees (including owners)

If you have no employees, you can put one in this box. Otherwise, provide the headcount of all employees including yourself, even if you are not on payroll.

Part 2: Loan amount calculation

There are two sections for calculating your PPP loan amount: one for businesses with employees and one for business without.

Loan amount calculation without employees (other than owners)

Start with your gross income from your 2019 or 2020 Schedule C. This amount is reported on line 7. Put this amount in box A.

In box B, divide this value by 12. If the value is greater than $8,333.33, you must use $8,333.33. Multiply box B by 2.5 and use that value to fill box C. This will be your PPP loan amount.

Businesses in the restaurant and bar industry can multiply box B by 3.5 to get their PPP loan amount. These businesses must have a NAICS code that begins with 72.

Loan amount calculation with employees

Start by calculating your gross income minus any payroll costs as reported on a 2019 or 2020 Schedule C. This can be found by taking the amount reported on line 7 and subtracting the amounts in lines 14, 19, and 26. Put this amount in box A.

In box B, divide this value by 12. If the value is greater than $8,333.33, you must use $8,333.33.

In box C, you must report your average payroll expenses. You can review how to calculate the average monthly payroll expense in Part 2 of our form 2483-SD overview above.

Finally, add boxes B and C together. Multiply this amount by 2.5 (or 3.5 if your NAICS code begins with 72) to find your PPP loan amount. PPP loan amounts are capped at $2 million. Put the lesser of your calculated loan amount and $2 million dollars in your Loan Request Amount box.

Purpose of the loan

Select all that apply. Regardless of if you have employees, Payroll Costs should be checked off. This will include the owner compensation you can take. The purpose of the program is to protect paychecks, if this box is not checked, it’s possible your application may be denied.

PPP First Draw SBA Loan Number

The PPP loan you received in 2020 is considered your first draw PPP loan. You can find this number on the loan offer you received.

If you cannot find your loan offer, reach out to your previous lender. Most lenders will have this information available in an online portal you can access.

Part 3: Reduction in gross receipts

A new eligibility requirement for second draw PPP loans is showing you experienced a 25% reduction in gross receipts.

For loan amounts of $150,000 or less, this section can be left blank. However, you will be asked to provide this information either when you apply for forgiveness, or beforehand.

To calculate the reduction in gross receipts,you can use:

- Any quarter in 2020 and compare it with the same quarter in 2019

- Compare your annual 2020 and 2019 gross receipts

If you choose to use annual numbers, put “Annual” in the 2020 quarter and reference quarter boxes.

If your business opened in 2020 but was operational on February 15, 2020, you must use Q1 2020 as the reference quarter. The 25% reduction in revenue must be shown by comparing either Q2, Q3, or Q4 2020 with Q1 2020.

Further reading: How to Calculate a 25% Reduction in Revenue for PPP 2

Part 4: Applicant Ownership

List all members of the ownership that hold 20% or more of the business. If you have more owners than spaces on the application, attach them as a separate sheet.

Part 5: Applicant Demographic Information (Optional)

This section is completely voluntary and will be used for reporting purposes only. Any information you provide here will not impact your loan application.

Part 6: Questionnaire

Answer each question and initial where indicated. Answering yes to questions 1, 2, 4, or 5 will mean you are ineligible for a PPP loan.

Part 7: Certifying you applied in good faith

On page three of the application form, there are 15 statements. Each statement must be signed to certify you are applying in good faith that these statements apply to your business. Signing on any of these statements later found untrue can result in penalties through imprisonment or fines.