Bookkeeping and Accounting for Homeopaths

Looking for a bookkeeper and accountant for your homeopathy practice? We do your books, so you get more time to focus on healing and wellness. Try us for free.

No credit card required. By clicking ‘Get Started’, I agree to Bench’s Terms & Privacy Policy.

How Bench works with homeopaths

Discover seamless bookkeeping, income tax prep, and filing solutions as a homeopath—delivered by experts, reinforced by one powerful platform. Bench collaboratively works with homeopaths.

We get you set up

Our team commits to gaining a comprehensive understanding of your homeopathy practice, answering your queries, assisting you in connecting your accounts, and demonstrating how Bench can effectively operate with your business.

We do your bookkeeping

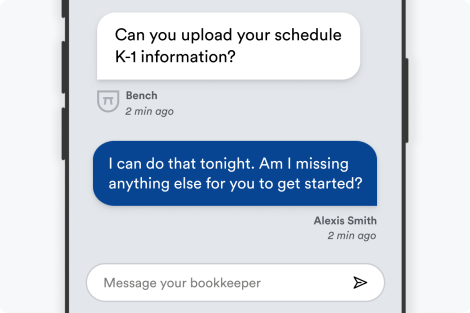

Each month, your dedicated bookkeeper sorts out your homeopathic business transactions and formulates financial statements. Should they require any additional information from you, they will promptly reach out.

We deliver tax-ready financials

Our team of experts is well-versed in homeopathy business regulations and will tailor their methodology to meet the distinct requirements of your practice.

Here’s why homeopaths like you trust Bench with their bookkeeping and accounting

Get fast, unlimited support from our expert advisors

At Bench Accounting, we understand the unique bookkeeping needs of homeopathy clinics. Expect regular updates on your finances, so you're never left guessing. Have urgent concerns that just can't wait? Rest assured we'll respond within one business day or less.

Guaranteed accuracy in every detail

Bench Accounting provides an automated platform tailored to your homeopathy practice, streamlining data inputs from major providers to eliminate common errors. We collaborate with celebrated partners like Gusto, Stripe, Shopify, and Square to ensure your financial records always remain accurate.

See where you’re spending. Make smart decisions

Say farewell to heaps of paper records and laborious hand-operated monitoring—we streamline data directly from your synced accounts. Utilize insights from a single main dashboard designed for homeopaths, simplifying your comprehension of your practice's wellbeing and enabling you to make informed decisions.

Bench integrates with your favorite small business tools

We sync seamlessly with your financial accounts and tools to keep your books up-to-date and save you the time and effort of manually uploading documents.

Trusted by 25,000+ American small business owners

CHRIS RONZIO

DR. BUKKY KOLAWOLE

HEATHER SHOLL

We know bookkeeping for homeopaths

For homeopaths, keeping track of financial transactions, revenue, expenses, and tax requirements are as essential as effectively treating patients. However, the intricacies of industry-specific taxes, law compliance, and bookkeeping takes valuable time away from focusing on patient care. At Bench, we understand the bookkeeping requirements for homeopathy practitioners, including the daily tracking of income and expenditure, managing insurance claims, the calculation of sales tax on products sold, and more. We offer our expertise in providing solutions to common bookkeeping challenges in your industry, freeing you to concentrate on healing.

Bench offers more than just bookkeeping - we are your partner in managing financial health, offering practical insights, and helping overcome complex challenges related to taxes. For instance, navigating the issue of sales taxes for over-the-counter remedies, understanding taxation for homeopathic-related products, or compliance with financial regulations specific to the healthcare industry. Our software simplifies this overwhelming task, backed by our team of human bookkeepers who understand the unique laws and taxes of the homeopathy sector. In essence, Bench takes care of bookkeeping and tax for small business owners in ways that save time, reduce stress, and promote a more effective business practice.

Simple, straightforward pricing for everything your business needs.

Get bookkeeping, tax prep, advisory, and filing with Bench's powerful, easy-to-use platform.

Choose Plan

Essential

billed annually

Premium

billed annually

Essential

billed monthly

Premium

billed monthly

Frequently Asked Questions

Yes, in many cases, categorizing your homeopathic remedies and services differently can simplify your bookkeeping process. Differentiation allows for more precise tracking of sales, inventory, and expenses related to each service or product line. Furthermore, tax laws may apply differently to different categories of products or services, so proper categorization can aid in tax preparation. Always consult with a professional bookkeeper who is familiar with your industry to ensure accurate record-keeping.

Effectively managing accounting for your homeopathy business can be accomplished in a few steps:

- Organize your financial paperwork: This involves keeping track of all your invoices, receipts, and other financial documents, either physically or digitally.

- Separate personal and business finances: Having separate accounts for your business and personal funds can help to get a clearer picture of your business performance.

- Use accounting software: This can help automate some of your accounting tasks, such as tracking income and expenses, generating financial reports, and invoicing.

- Hire a professional: A bookkeeper or accountant can provide expert advice, help you to stay on track with your financial goals, and ensure your business remains compliant with tax laws. At Bench Accounting, we provide efficient bookkeeping solutions tailored to the needs of homeopathy businesses.

As a homeopath, you may be eligible for numerous tax deductions, including expenses related to your home office, professional training and development, health insurance premiums, travel, and meals related to your business. Moreover, you may also qualify for business deductions including the costs of equipment and supplies, business insurance and licenses, and advertising and marketing. Each tax situation varies, so it's advised that you work with a professional bookkeeper who is knowledgeable about your specific industry. Please note that tax laws frequently change, so always check with a tax professional or the IRS for the most current information.

Nope! All bookkeeping is completed in-house.

Your bookkeeper will be your main point of contact, but at times you might hear from another member of your team. This is usually when your bookkeeper goes on vacation, is sick, or otherwise unavailable.

We handle the bookkeeping for you but sometimes we’ll need your input, especially at year-end. On average, expect to spend 15 minutes each month answering questions for your bookkeeper, or uploading supporting docs.

Bookkeeping Services for Homeopaths

Sign up for a Bench trial, and get one month free. If you decide to go with us, we’ll take bookkeeping off your plate—for good.

No credit card required. By clicking ‘Get Started’, I agree to Bench’s Terms & Privacy Policy.