Bookkeeping and Accounting for Car Rental Services

Seeking a bookkeeper and accountant for your car rental service? Let us handle your books, so you can shift gears and focus on smooth rides and customer satisfaction. Try us for free.

No credit card required. By clicking ‘Get Started’, I agree to Bench’s Terms & Privacy Policy.

How Bench works with car rental services

Drive your car rental service business forward with Bench. Our expert team takes care of your bookkeeping, income tax prep, and filing—backed by one powerful platform, specially engineered for businesses like yours. Bench is committed to accelerating the financial success of car rental services.

We get you set up

Our squad takes the initiative to thoroughly appreciate your car rental service, address your inquiries, assist you in connecting your accounts, and illustrate how Bench integrates with your business.

We do your bookkeeping

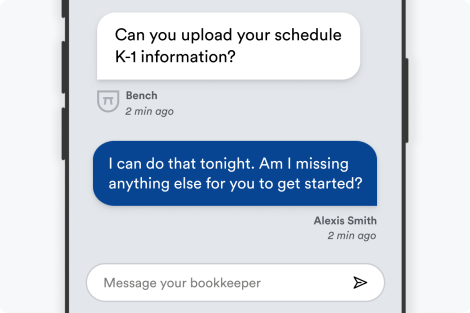

Every month, your dedicated bookkeeper meticulously records and manages all your car rental service transactions and compiles comprehensive financial reports. If they require additional information from you, they’ll promptly reach out.

We deliver tax-ready financials

Our team of experts is well-versed in car rental service tax rules across the US and will personalize their approach to meet your business's distinctive requirements.

Here’s why car rental services like you trust Bench with their bookkeeping and accounting

Get fast, unlimited support from our expert advisors

We will frequently provide you with updates on your bookkeeping. Have urgent queries that can't be put on hold? We guarantee responses within one business day or less, keeping your car rental service business moving smoothly.

Guaranteed accuracy in every detail

Our platform streamlines the automation of data inputs from the key providers in your industry, mitigating potential errors. We collaborate with merchant providers significant to car rental services—which means your financial books are consistently accurate and up-to-date.

See where you’re spending. Make smart decisions

No more heaps of receipts and laborious manual logs—Bench Accounting streamlines your processes by automating inputs directly from interconnected accounts for your car rental service business. Gain clear insights from a single comprehensive dashboard, enabling you to effortlessly comprehend the fiscal health of your company and make informed strategic decisions.

Bench integrates with your favorite small business tools

We sync seamlessly with your financial accounts and tools to keep your books up-to-date and save you the time and effort of manually uploading documents.

Trusted by 25,000+ American small business owners

CHRIS RONZIO

DR. BUKKY KOLAWOLE

HEATHER SHOLL

We know bookkeeping for car rental services

Navigating through the complexities of bookkeeping in the car rental services industry has never been this easy. At Bench, we understand the industry's unique challenges including high depreciation rates, wear and tear costs, volatile fuel prices, different rental agreements, and more. Coupled with industry-specific taxes and laws that may vary by state or country, it can quickly become overwhelming for car rental business owners to manage their finances successfully. By integrating intuitive software with a team of expert human bookkeepers, Bench simplifies this entire process, addressing all these industry-specific bookkeeping issues cohesively and efficiently.

Our dedicated team at Bench is familiar with the tax laws governing the car rental sector. We aid in tracking allowable expenses such as insurance, vehicle maintenance, depreciation, and interest costs. And when it comes to sales tax, we ensure precision in calculating and remitting the correct amount according to the varying rates across states or countries. Our services extend to managing multi-channel revenue streams, tracking assets, and amortizing your fleet. We do not just take care of your day-to-day bookkeeping tasks but also ensure you are well prepared for tax time. With Bench handling your bookkeeping and taxes, you can better focus on delivering exceptional services to your customers and driving the growth of your car rental business.

Simple, straightforward pricing for everything your business needs.

Get bookkeeping, tax prep, advisory, and filing with Bench's powerful, easy-to-use platform.

Choose Plan

Essential

billed annually

Premium

billed annually

Essential

billed monthly

Premium

billed monthly

Frequently Asked Questions

Your car rental service business can claim a variety of expenses to lower taxable income. These expenses can be broadly categorized into the following:

- Operating expenses: This would include things like fuel, repairs, maintenance, insurance and licensing fees.

- Depreciation: Your business might be able to claim a depreciation deduction for cars you own and use in your rental service.

- Interest on loans: If you've taken loans to purchase cars for your rental fleet, the interest on those loans can be claimed as an expense.

- Employee salaries: Payments to employees, whether they are mechanics, office staff or drivers, can be claimed as an expense.

- Marketing and advertising costs: Any money spent on promoting your car rental business can also be claimed.

- Costs related to your place of business: This includes rent, utilities, property tax, and other similar expenses.

Always consult with a professional tax advisor to ensure that you're taking full advantage of the deductions available to your car rental business and complying with all relevant tax laws.

Capital depreciation refers to the decrease in the value of an asset over time due to factors like wear and tear, obsolescence or economic factors. With respect to vehicles in a car rental service, depreciation begins the moment a car is bought and continues over its useful lifespan.

Depreciating assets, such as vehicles, for tax purposes can be beneficial for businesses. The annual depreciation expense reduces the net income, and therefore the amount of tax payable. In car rental services, the depreciation of the vehicles can be calculated and written off against the company's revenue each year, significantly reducing the amount of taxable income and thereby reducing tax liabilities.

There are different kinds of method to calculate depreciation, including Straight Line Basis, Declining Balance Method, and Sum of the Year’s Digits. The choice of method will depend on your specific business circumstances. It's recommended to consult with a bookkeeper or accountant to get a thorough understanding of which method is best and most compliant for your business.

The specific accounting needs for tracking multiple fleet vehicles and associated liabilities in a car rental business often involve a high degree of detail and organization. It is essential to have an organized system for tracking the various costs associated with each vehicle, such as maintenance, fuel, insurance, and depreciation. Additionally, understanding the liabilities associated with vehicle rentals, including accident-related costs and the legal implications of mishaps, is principal as well.

All these details significantly affect a car rental company's bottom line. They need to be monitored and recorded accurately for financial reports and to meet tax requirements. Employing a bookkeeper who is experienced in fleet tracking and associated liabilities can ensure that your financial records are expertly managed, freeing you up to concentrate on other aspects of your business.

Nope! All bookkeeping is completed in-house.

Your bookkeeper will be your main point of contact, but at times you might hear from another member of your team. This is usually when your bookkeeper goes on vacation, is sick, or otherwise unavailable.

We handle the bookkeeping for you but sometimes we’ll need your input, especially at year-end. On average, expect to spend 15 minutes each month answering questions for your bookkeeper, or uploading supporting docs.

Bookkeeping Services for Car Rental Services

Sign up for a Bench trial, and get one month free. If you decide to go with us, we’ll take bookkeeping off your plate—for good.

No credit card required. By clicking ‘Get Started’, I agree to Bench’s Terms & Privacy Policy.