Bookkeeping and Accounting for Blacksmiths

Looking for a bookkeeper and accountant for your blacksmith business? We'll handle your books, so you can forge ahead and focus on your craftsmanship. Try us for free.

No credit card required. By clicking ‘Get Started’, I agree to Bench’s Terms & Privacy Policy.

How Bench works with blacksmiths

Forge ahead with your business, leaving the financial stresses behind. Get your bookkeeping, income tax prep, and filing done by experts—tailored for blacksmiths and backed by one powerful platform. Bench works seamlessly with blacksmiths.

We get you set up

Our team takes the time to thoroughly comprehend your blacksmith business, address your queries, assist you in integrating your accounts, and demonstrate how Bench can facilitate your work.

We do your bookkeeping

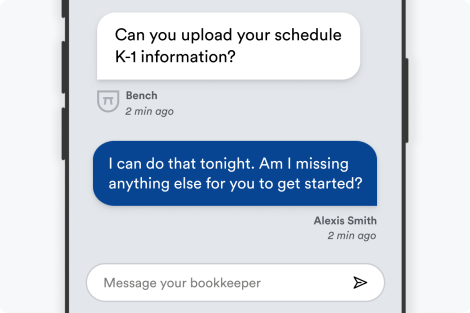

Each month, your personal bookkeeper sorts out your blacksmithing transactions and compiles your financial reports. If they require any additional information from you, they'll make sure to contact you.

We deliver tax-ready financials

Our team of experts is familiar with US tax regulations and will tailor their approach to meet the individual requirements of your blacksmithing business.

Here’s why blacksmiths like you trust Bench with their bookkeeping and accounting

Get fast, unlimited support from our expert advisors

We'll consistently provide you with up-to-date bookkeeping records, tailor-made for blacksmiths. Have urgent concerns that simply can't be delayed? We pledge to respond to your queries within one business day or even less.

Guaranteed accuracy in every detail

Our platform streamlines your financial tasks by automating data entries from prevailing providers, dodging typical errors. We associate with industry-giants like Gusto, Stripe, Shopify, and Square—ensuring your blacksmithing business's finances are always precise and up-to-date.

See where you’re spending. Make smart decisions

Say farewell to mountains of receipts and endless hours spent on manual record tracking—we streamline inputs directly from your connected accounts. Gain insights from a single, centralized dashboard, enabling you to effortlessly comprehend your blacksmith business's financial health and make strategic decisions expertly.

Bench integrates with your favorite small business tools

We sync seamlessly with your financial accounts and tools to keep your books up-to-date and save you the time and effort of manually uploading documents.

Trusted by 25,000+ American small business owners

CHRIS RONZIO

DR. BUKKY KOLAWOLE

HEATHER SHOLL

We know bookkeeping for blacksmiths

Craftsmen like blacksmiths are skilled at forging and shaping iron, but navigating the intricate world of bookkeeping and tax compliance may be a challenge. With Bench, it doesn't have to be. We understand the unique tax implications and laws associated with the blacksmithing industry, from filing for the correct tax deductions related to acquiring raw materials, to managing the overhead costs associated with running a furnace. Blacksmiths often grapple with inventory management, income tracking, and pricing their hand-crafted wares. These are common bookkeeping issues that may impact your business's profitability and tax obligations.

Bench revolutionizes how small businesses like yours handle bookkeeping and tax, by marrying powerful software with real-life bookkeepers. Our certified bookkeepers are experienced in handling industry-specific financial matters and are well-versed with blacksmithing industry regulations. It can be overwhelming to manage production, design, sales, while also keeping pace with fiscal responsibilities; and that’s where we come in. We not only help keep your books accurate and up-to-date but also guide you through your tax season, making sure you claim all applicable tax deductions and stay compliant with industry laws. At Bench, we’re not just crunching numbers- we’re empowering small business owners, freeing them to focus on their craftsmanship.

Simple, straightforward pricing for everything your business needs.

Get bookkeeping, tax prep, advisory, and filing with Bench's powerful, easy-to-use platform.

Choose Plan

Essential

billed annually

Premium

billed annually

Essential

billed monthly

Premium

billed monthly

Frequently Asked Questions

As a blacksmith, there are several specific accounting considerations you need to take into account. One of the major ones is the cost of tools and equipment. In accounting terms, these are considered capital expenses.

A capital expense (CAPEX) is a significant amount of money put in by a company to purchase, maintain, or upgrade fixed assets, such as buildings, vehicles, or equipment. In the case of a blacksmith, these would include your forge, anvil, hammers, and other blacksmithing tools.

Due to their value and long-term use, these costs are often spread over the duration of their usage in a process called capitalization. This is significant because it affects how your income will be calculated.

It's also important to note that the IRS allows businesses to write off a portion of these CAPEX as a tax deduction, through a process known as depreciation, which over time, can lead to significant cost savings.

However, keep in mind that accounting rules around capital expenses and depreciations are complex and often change. As such, it's usually a good idea for professionals in specialized industries like blacksmithing, to seek out the services of a knowledgeable bookkeeper or accountant who can help you navigate the tax landscape and ensure you're meeting your financial obligations.

Yes, Bench Accounting can definitely assist in identifying potential tax deductions for your blacksmithing profession. Our experienced team of bookkeepers has comprehensive knowledge about various allowable deductions specific to different industries and professions. They can guide you through tax-deductible expenses, ensuring you capitalize on every possible business deduction during tax season. This way, you can ensure accurate and optimized accounting for your blacksmithing profession.

Bench Accounting services can greatly help you manage your income flow during your blacksmithing profession's peak and slow seasons. With a professional bookkeeper tracking your income and expenses, it becomes easier to visualize your financial performance. This can help you understand when you're earning the most revenue and when you're spending the most resources.

Bench provides monthly financial statements letting you know exactly where you stand during all seasons, peak or slow. This data allows you to plan ahead, budget effectively, and make necessary adjustments. Additionally, if there's an unusual change, your bookkeeper will take notice and can help you understand what's happening.

They can also help strategize for the slow season by recommending effective tax strategies, providing insights into cash flow patterns, and suggesting ways to save costs. Ultimately, Bench provides a committed bookkeeper to provide you with the right advice, ensure your books are organized, accurate, and offer help whenever you need it.

Nope! All bookkeeping is completed in-house.

Your bookkeeper will be your main point of contact, but at times you might hear from another member of your team. This is usually when your bookkeeper goes on vacation, is sick, or otherwise unavailable.

We handle the bookkeeping for you but sometimes we’ll need your input, especially at year-end. On average, expect to spend 15 minutes each month answering questions for your bookkeeper, or uploading supporting docs.

Bookkeeping Services for Blacksmiths

Sign up for a Bench trial, and get one month free. If you decide to go with us, we’ll take bookkeeping off your plate—for good.

No credit card required. By clicking ‘Get Started’, I agree to Bench’s Terms & Privacy Policy.