Bookkeeping and Accounting for Tile Setters

Searching for a bookkeeper and accountant for your tile setting business? We manage your books, so you get more time to focus on crafting perfect tile installations. Try us for free.

No credit card required. By clicking ‘Get Started’, I agree to Bench’s Terms & Privacy Policy.

How Bench works with tile setters

Get your bookkeeping, income tax prep, and filing done by experts—tailored for the unique needs of tile setters and backed by one powerful platform. Bench works with tile setters.

We get you set up

Our team takes the time to thoroughly understand the ins and outs of your tile setting business, answer any inquiries you may have, assist you in connecting your accounts, and guide you on how Bench can streamline your bookkeeping.

We do your bookkeeping

Each month, your dedicated bookkeeper sorts out your tile setting business transactions and compiles financial reports. If they require any further information from you, they'll promptly reach out.

We deliver tax-ready financials

Our team of experts is knowledgeable in tax regulations related to tile setting businesses and will tailor their methods to your specific requirements.

Here’s why tile setters like you trust Bench with their bookkeeping and accounting

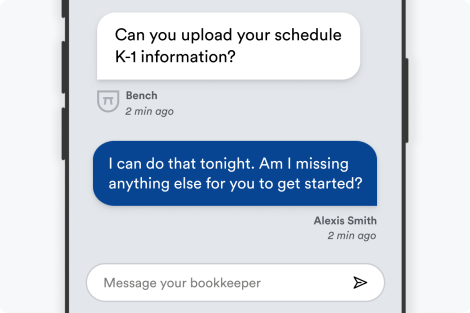

Get fast, unlimited support from our expert advisors

At Bench Accounting, we understand that as tile setters, you’re busy crafting beautiful spaces, and paperwork is the last thing on your mind. That's why we regularly provide bookkeeping updates so you never have to worry about your financials. Have urgent concerns that just can't hold off? Rest assured, we'll respond to your queries in one business day or less.

Guaranteed accuracy in every detail

Our platform enables you to automate data recording from majority of the leading suppliers to eliminate typical errors. We collaborate with vendors like Gusto, Stripe, Shopify, and Square—ensuring your financial records as a tile setter are always precise.

See where you’re spending. Make smart decisions

Say farewell to mountains of invoices and the tedious task of manual record-keeping—we seamlessly automate entries straight from your linked accounts. Get real-time insights from one convenient dashboard, enabling you to quickly comprehend the financial wellbeing of your tile setting business and make calculated decisions.

Bench integrates with your favorite small business tools

We sync seamlessly with your financial accounts and tools to keep your books up-to-date and save you the time and effort of manually uploading documents.

Trusted by 25,000+ American small business owners

CHRIS RONZIO

DR. BUKKY KOLAWOLE

HEATHER SHOLL

We know bookkeeping for tile setters

For tile setters, it's common to find yourself juggling multiple projects, bidding on new jobs, and managing materials and labour costs. During these busy moments, bookkeeping tasks such as managing invoices, cash flow, or tax preparation may be pushed to the sidelines, creating potential financial issues later. Bench understands these unique challenges faced by those in the tile setting industry. We provide an all-in-one bookkeeping solution designed to handle your business's financial tasks, giving you more time to focus on what you do best.

At Bench, we're not just familiar with the general bookkeeping; we also understand the specific tax laws and industry regulations that apply to tile setters. We are aware of the detailed expenses and deductions applicable in this industry like tools, materials, vehicle expenses, and other unique costs. Our team will take care of managing these details accurately, ensuring your financial statements reflect a true picture of your business. When tax season comes, we'll ensure your tax filings are in order, taking into account industry-specific tax deductions. With Bench, your bookkeeping isn't simply managed—it's transformed, saving you time, stress, and potential financial pitfalls.

Simple, straightforward pricing for everything your business needs.

Get bookkeeping, tax prep, advisory, and filing with Bench's powerful, easy-to-use platform.

Choose Plan

Essential

billed annually

Premium

billed annually

Essential

billed monthly

Premium

billed monthly

Frequently Asked Questions

As a tile setter, there are a number of specific expenses you can claim in your accounting books:

- Contract Labor: If you hire subcontractors or laborers to help with jobs, you can deduct these costs.

- Supplies and Materials: The costs of tiles, grout, and other materials needed for your jobs can be deducted.

- Tools and Equipment: If you've purchased tools or equipment necessary for your tiling work, these can be deducted. This includes tile cutters, trowels, mixers, and other related tools.

- Vehicle Expenses: If you use your vehicle for work purposes, such as driving to job sites or picking up supplies, you can claim these expenses.

- Home Office: If you use a part of your home exclusively for business, you may be able to claim the home office deduction.

- Insurance, Licenses, and Fees: The cost of business insurance, professional licenses, and regulatory fees are all deductible.

Please remember that tax laws can be complex and change frequently. It's always a good idea to consult with a professional bookkeeper or accountant to ensure that you are correctly reporting and deducting your business expenses.

The bookkeeping for a tile setting business should account for the cost of materials and labor precisely and systematically. These costs are usually categorized as Cost of Goods Sold (COGS).

Cost of Materials: This should include the cost of all the tiles and other materials used for setting tiles. Keep detailed records of every purchase made. All invoices and receipts should be properly filed and recorded.

Labor Costs: The cost of labor should include all wages paid to employees, including overtime pay, bonuses, and benefits. It's also necessary to account for any subcontracted work.

Both of these costs directly influence the profitability of the tile setting business and are essential for calculating gross profit, which is a key financial indicator of a business's operational performance. Accurate bookkeeping ensures you can track these costs and make proactive business decisions.

Common bookkeeping practices for managing the financials of a tile setting business include:

- Recording Expenses: All business-related expenses such as material costs, labor, transportation, and equipment rentals should be accurately recorded.

- Job Costing: It is crucial to track all costs associated with a specific project or job to determine the actual profitability of each job.

- Invoicing: Timely and accurate invoicing is essential for cash flow. Details such as date, materials, labor costs, and any other charges should be included in the invoice.

- Payroll Management: Bookkeepers should handle payroll in compliance with applicable local, state, and federal tax laws.

- Tax Preparation: Accurate record-keeping makes tax filing much easier and ensures you exploit all tax benefits applicable to your tile setting business.

- Reconciliation of Accounts: Regular checking of all your business accounts against their statements can help detect any discrepancies and prevent financial mismanagement.

Since the bookkeeping needs of each tile setting business can vary based on many factors, it is usually recommended to seek professional help to ensure the financial health of the business.

Nope! All bookkeeping is completed in-house.

Your bookkeeper will be your main point of contact, but at times you might hear from another member of your team. This is usually when your bookkeeper goes on vacation, is sick, or otherwise unavailable.

We handle the bookkeeping for you but sometimes we’ll need your input, especially at year-end. On average, expect to spend 15 minutes each month answering questions for your bookkeeper, or uploading supporting docs.

Bookkeeping Services for Tile setters

Sign up for a Bench trial, and get one month free. If you decide to go with us, we’ll take bookkeeping off your plate—for good.

No credit card required. By clicking ‘Get Started’, I agree to Bench’s Terms & Privacy Policy.