Bookkeeping and Accounting for Tattoo Artists

Looking for a bookkeeper and accountant for your tattoo studio? We handle your books, so you have more time to focus on perfecting your ink mastery. Try us for free.

No credit card required. By clicking ‘Get Started’, I agree to Bench’s Terms & Privacy Policy.

How Bench works with tattoo artists

Get your bookkeeping, income tax prep, and filing done by experts—tailored specifically for the creative flair of your tattoo business. Bench seamlessly synchronizes with tattoo artists.

We get you set up

Our team invests the time to thoroughly comprehend your tattoo artistry business, respond to your inquiries, assist you in connecting your accounts, and demonstrate how Bench can streamline your operations.

We do your bookkeeping

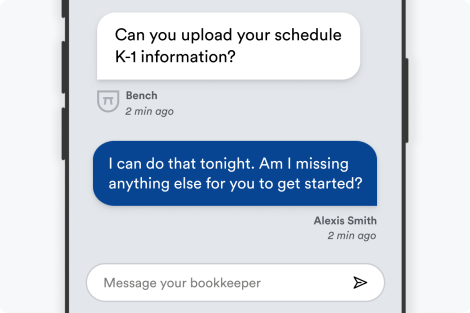

Each month, your dedicated bookkeeper categorizes your tattoo studio transactions and prepares detailed financial statements. If they require further information from you, they'll promptly reach out.

We deliver tax-ready financials

Our team of experts are well-versed in tattoo industry tax regulations and will adapt their approach based on your tattoo business' specific requirements.

Here’s why tattoo artists like you trust Bench with their bookkeeping and accounting

Get fast, unlimited support from our expert advisors

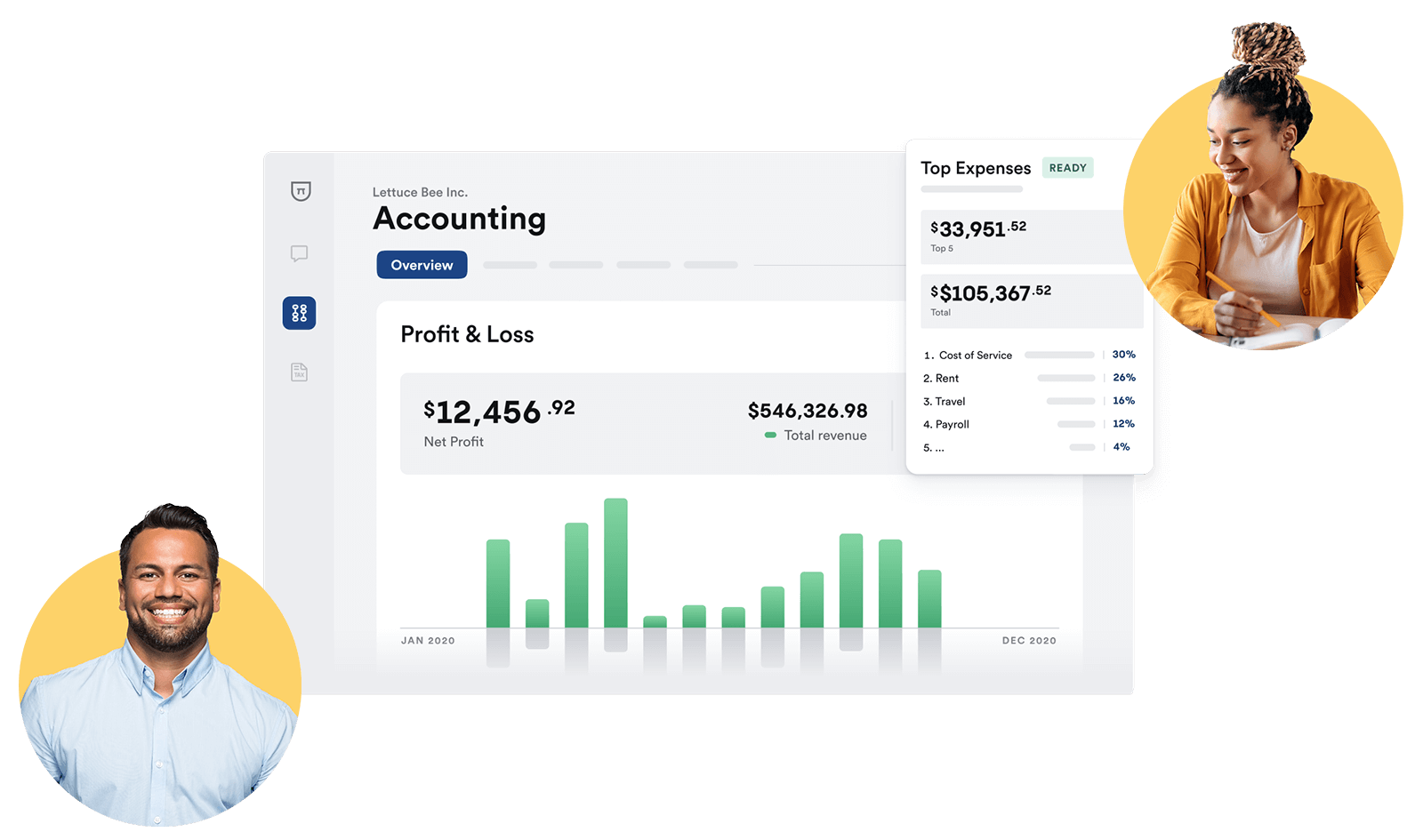

Stay focused on your artwork, we'll handle the numbers. We'll provide periodic bookkeeping updates tailored to tattoo artists so you can easily monitor your financing. Have urgent queries that can't wait? We're committed to responding within one business day or less.

Guaranteed accuracy in every detail

Our platform is designed to streamline data inputs from top-tier sources, ensuring error-free bookkeeping for your tattoo studio. We collaborate with leading commerce platforms such as Gusto, Stripe, Shopify, and Square—guaranteeing that your financials are consistently precise.

See where you’re spending. Make smart decisions

Say goodbye to heaps of paperwork and laborious manual record-keeping—we handle the automation directly from your linked accounts. Get insights from one consolidated dashboard so you can effortlessly understand the state of your tattoo studio and make informed strategic decisions.

Bench integrates with your favorite small business tools

We sync seamlessly with your financial accounts and tools to keep your books up-to-date and save you the time and effort of manually uploading documents.

Trusted by 25,000+ American small business owners

CHRIS RONZIO

DR. BUKKY KOLAWOLE

HEATHER SHOLL

We know bookkeeping for tattoo artists

Working in the tattoo industry comes with its own unique set of financial challenges. Keeping track of flash creation, equipment expenses, studio rent, and other operational costs can be overwhelming. Coupled with the complexity of industry-specific tax laws, the importance of having an expert bookkeeping service becomes apparent. Bench Accounting understands the intricacies of the tattoo industry, our team is ready to manage these challenges, ensuring your finances align with the unique laws and tax regulations of your trade.

Bench pairs intuitive software with real, human bookkeepers to make your business financials simpler and understandable. We do more than just keep your books. We also assist with tax filing, help you understand your business' financial health, and plan better for your future. Our expert team will handle everything from cataloging your income and expenses, managing receipts for your supplies and tools, to preparing your tax documents. Instead of worrying about bookkeeping and taxes, tattoo artists can focus on what they do best – creating art. At Bench, we're not just your bookkeepers, we're your financial partners in the art world.

Simple, straightforward pricing for everything your business needs.

Get bookkeeping, tax prep, advisory, and filing with Bench's powerful, easy-to-use platform.

Choose Plan

Essential

billed annually

Premium

billed annually

Essential

billed monthly

Premium

billed monthly

Frequently Asked Questions

As a tattoo artist, there are numerous specific expenses you can claim to help reduce your tax liabilities. These include:

- Tattoo Supplies: These are considered necessary business expenses. They include inks, needles, gloves, cleaning supplies, tattoo machines, etc.

- Rent: If you rent a space for your tattoo parlor, you can deduct that expense. If you are a home-based artist, you may also be able to claim home office deductions.

- Professional Development: Workshops, trade shows, books, and other resources to improve your skills can generally be deducted.

- Marketing and Advertising: Expenses on business cards, flyers, ads, website maintenance, and other advertising methods are deductible.

- Insurance: Business insurance premiums can be deducted.

- Equipment: Larger equipment purchases, such as tattoo chairs or specialized lighting, can often be depreciated over several years.

This is not an exhaustive list and many more expenses may apply depending on your specific situation. Always consult with a bookkeeper or a tax advisor to ensure you are claiming all allowable deductions.

Organizing income from different sources doesn't have to be a challenge. One option is to create different categories or accounts in your bookkeeping software for each income source, such as tattoo services, art sales, and merchandise. You can then record the respective income under each category. Our team at Bench Accounting can also assist with this. We can setup and manage a comprehensive bookkeeping system designed specifically for your business, making it easy for you to keep track of your income sources and giving you more time to focus on growing your business. If you want to learn more or need help getting started, feel free to contact us.

The type of accounting method you should use largely depends on your business model and the specific requirements of your industry. As a general rule, most businesses use either the cash-based accounting method or the accrual accounting method.

Cash-based accounting: This is the simplest method and is ideal for small businesses. In this method, income is recorded when you receive it and expenses are recorded when they're paid.

Accrual accounting: This is a more complex method generally used by larger businesses and corporations. In accrual accounting, income and expenses are recorded when they're billed and earned, rather than when money changes hands.

It's crucial to consult with a professional bookkeeper or accountant to determine the best method for your particular business needs.

Nope! All bookkeeping is completed in-house.

Your bookkeeper will be your main point of contact, but at times you might hear from another member of your team. This is usually when your bookkeeper goes on vacation, is sick, or otherwise unavailable.

We handle the bookkeeping for you but sometimes we’ll need your input, especially at year-end. On average, expect to spend 15 minutes each month answering questions for your bookkeeper, or uploading supporting docs.

Bookkeeping Services for Tattoo artists

Sign up for a Bench trial, and get one month free. If you decide to go with us, we’ll take bookkeeping off your plate—for good.

No credit card required. By clicking ‘Get Started’, I agree to Bench’s Terms & Privacy Policy.