Bookkeeping and Accounting for Sculptors

Looking for a bookkeeper and accountant for your sculpting practice? We handle your books, so you can get more time to transform a piece of stone into art. Try us for free.

No credit card required. By clicking ‘Get Started’, I agree to Bench’s Terms & Privacy Policy.

How Bench works with sculptors

Find more time to craft your masterpieces by letting Bench handle your bookkeeping, income tax prep, and filing. Trusted by professionals and creatives alike, Bench seamlessly integrates with your sculpting business.

We get you set up

Our team dedicates time to fully comprehend your sculpting business, answer your inquiries, assist you in connecting your accounts, and demonstrate how Bench can streamline your bookkeeping process.

We do your bookkeeping

Every month, your dedicated bookkeeper systematically organizes your sculpture business transactions and prepares financial statements. Should they require any additional information from you, they will promptly make contact.

We deliver tax-ready financials

Our team of experts is well-versed in tax regulations for the sculpting industry and will tailor their approach to your sculpting business's specific requirements.

Here’s why sculptors like you trust Bench with their bookkeeping and accounting

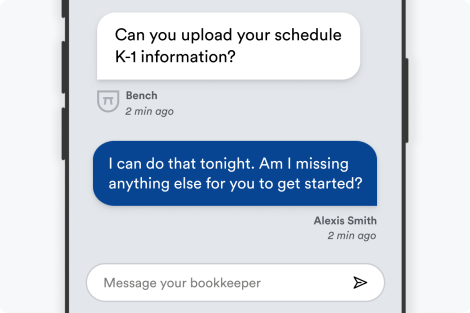

Get fast, unlimited support from our expert advisors

Frequent updates on your bookkeeping? That's our promise to you. Facing pressing queries about your sculpting business finances that just can't wait? We assure you a response within one business day or less.

Guaranteed accuracy in every detail

Our platform lets you seamlessly automate data inputs from most leading providers, helping you evade the typical errors that plague manual input. We're in collaboration with suppliers such as Gusto, Stripe, Shopify, and Square—ensuring your financial records as a sculptor are always spot-on.

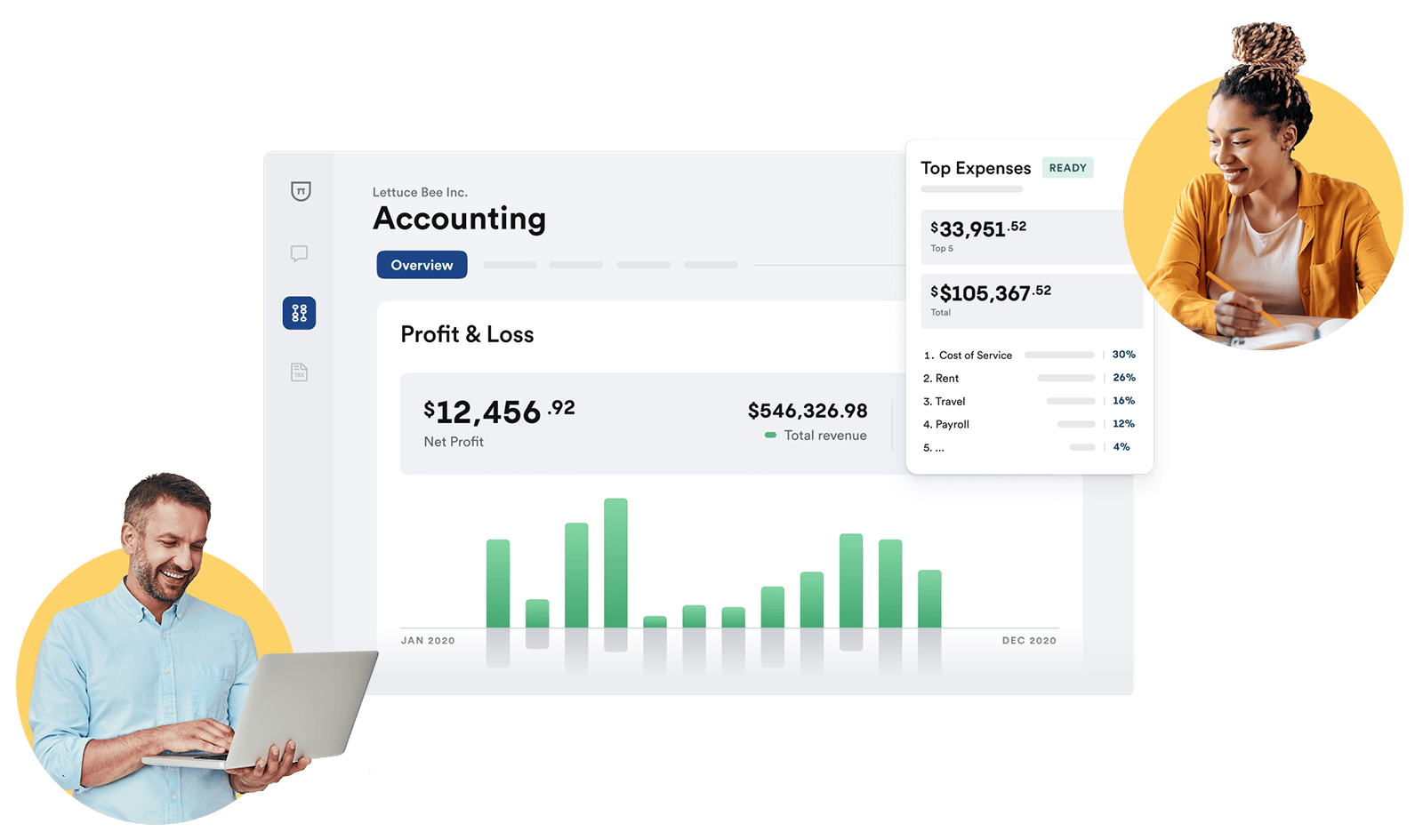

See where you’re spending. Make smart decisions

Wave farewell to the mountain of tedious paperwork and the hassle of manual record keeping. With Bench Accounting, we automate your bookkeeping tasks straight from your linked accounts. Gain insights from one easy-to-access dashboard so you can clearly comprehend the financial well-being of your sculpting business and make calculated, strategic decisions.

Bench integrates with your favorite small business tools

We sync seamlessly with your financial accounts and tools to keep your books up-to-date and save you the time and effort of manually uploading documents.

Trusted by 25,000+ American small business owners

CHRIS RONZIO

DR. BUKKY KOLAWOLE

HEATHER SHOLL

We know bookkeeping for sculptors

At Bench, we are extensively acquainted with the unique challenges encountered by sculptors. From tracking your material expenses, studio rental costs to keeping tabs on sales of your artworks, the financial side of your profession can get intricate and tiresome, draining your time and energy that could be better used honing your craft. Moreover, navigating the complexities of your industry-specific taxes and laws - such as self-employment taxes, deductions for art supplies and studio space, and sales taxes applied on the sale of your artwork - isn't an easy task. This is where Bench steps in.

Our dynamic pairing of advanced software and dedicated human bookkeepers ensures that your books are meticulously maintained, leaving no room for error. We'll track your expenses, income, and apply the appropriate deductions, so you don't have to fret about your financial health. Whether you sell your work through galleries, shows, or online platforms, Bench adapts to every facet of your business with ease. Beyond this, when tax season rolls around, we've got your back. Our expert team is familiar with the profession-specific nuances of tax laws and will work hard to get you the best tax outcome. With Bench, you can focus on what truly matters - creating beautiful art.

Simple, straightforward pricing for everything your business needs.

Get bookkeeping, tax prep, advisory, and filing with Bench's powerful, easy-to-use platform.

Choose Plan

Essential

billed annually

Premium

billed annually

Essential

billed monthly

Premium

billed monthly

Frequently Asked Questions

As a sculptor, you can claim back various expenses on your tax return as business deductions, including:

- Studio expenses: If you have a studio for your work, you can typically write off part or all of your rent and utilities. If you work from home, a portion of your mortgage and home expenses could be deductible.

- Supplies and materials: Expenses for supplies and materials used in your sculpting, such as clay, stone, bronze, tools, and other materials, can be claimed as deductions.

- Travel and vehicle use: If you travel for your art, you could deduct your travel expenses. If you use your car for your business, you can claim the business portion of your auto expenses.

- Advertising and promotion: Costs associated with marketing and promoting your work, such as advertising, website maintenance, and public relations can be claimed.

- Professional development: If you take courses to improve your sculpture skills, such costs could be deductible.

- Depreciation: If you have invested in expensive equipment for your sculpting, you may be able to claim depreciation.

Remember, each person's tax situation is unique so it's important to talk with a tax professional to make sure you're deducting all applicable expenses.

Recording income from sculpture sales or commissions should be done by creating an invoice for each sale or commission. The invoice should detail the name of the buyer or commissioning party, the date of the sale or completion of the commission, the amount charged, and a brief description of the work. It's also essential to categorize this income appropriately in your financial records - typically, this would fall under the 'Sales' category. Recording this way will ensure you have a clear and organized understanding of your income. It's advisable to consult with a professional bookkeeper to ensure correct implementation.

Bench offers comprehensive accounting support tailored towards the unique needs of professional artists, including sculptors. Our suite of services includes income and expense tracking, financial statement preparation, tax-ready financial summaries, and unlimited support with a team of expert bookkeepers. We understand the financial complexities that come with being an artist, and we are here to simplify and manage your accounting processes, allowing you more time to devote to creating great art.

Nope! All bookkeeping is completed in-house.

Your bookkeeper will be your main point of contact, but at times you might hear from another member of your team. This is usually when your bookkeeper goes on vacation, is sick, or otherwise unavailable.

We handle the bookkeeping for you but sometimes we’ll need your input, especially at year-end. On average, expect to spend 15 minutes each month answering questions for your bookkeeper, or uploading supporting docs.

Bookkeeping Services for Sculptors

Sign up for a Bench trial, and get one month free. If you decide to go with us, we’ll take bookkeeping off your plate—for good.

No credit card required. By clicking ‘Get Started’, I agree to Bench’s Terms & Privacy Policy.