Bookkeeping and Accounting for Makeup Artists

On the hunt for a bookkeeper and accountant for your makeup artistry? We'll handle your books, granting you more time to focus on enhancing beauty. Try us for free.

No credit card required. By clicking ‘Get Started’, I agree to Bench’s Terms & Privacy Policy.

How Bench works with makeup artists

Get your bookkeeping, income tax prep, and filing done by experts—backed by one powerful platform. Bench works hand-in-glove with makeup artists, letting you focus on enhancing beauty while we enhance your accounts.

We get you set up

Our team ensures to invest time to fully comprehend your makeup artistry business, address your queries, assist you in linking your accounts, and guide you on how Bench works.

We do your bookkeeping

Every month, your dedicated bookkeeper sorts out your makeup artist business transactions and compiles financial statements. If they require further information from you, they'll promptly get in touch.

We deliver tax-ready financials

Our team of experts is well-versed with tax regulations relevant to makeup artists and will tailor their approach to your unique business needs.

Here’s why makeup artists like you trust Bench with their bookkeeping and accounting

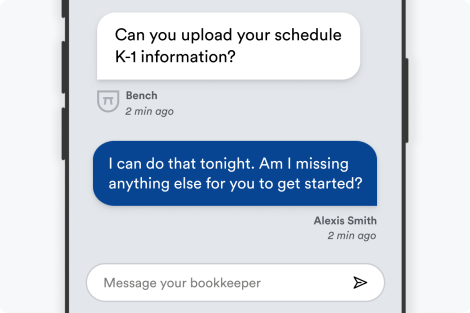

Get fast, unlimited support from our expert advisors

We'll proactively fill you in on your bookkeeping status, tailored to your makeup artist business. Got urgent queries that simply can't hold off? Expect a speedy response from us within just one business day, if not sooner.

Guaranteed accuracy in every detail

Our platform enables you to automate data inputs from most of the major providers to avert frequent errors. We collaborate with suppliers like Gusto, Stripe, Shopify, and Square—ensuring that your finance management as a makeup artist is always precise.

See where you’re spending. Make smart decisions

Bid farewell to stacks of client invoices and tedious manual tracking—we automate inputs directly from linked accounts for makeup artists. Garner insights from one comprehensive dashboard, enabling an effortless understanding of your financial standing and facilitating strategic decision-making for your artistry business.

Bench integrates with your favorite small business tools

We sync seamlessly with your financial accounts and tools to keep your books up-to-date and save you the time and effort of manually uploading documents.

Trusted by 25,000+ American small business owners

CHRIS RONZIO

DR. BUKKY KOLAWOLE

HEATHER SHOLL

We know bookkeeping for makeup artists

As a creative profession, makeup artists often have to juggle between their appointments, sourcing products, staying up-to-date with trends, and mastering their craft. In such a situation, bookkeeping can act as an unwanted distraction. At Bench, we provide a reliable solution for makeup artists, managing their financials while they focus on their creative endeavors. We are familiar with laws specific to the beauty industry and can help manage your expenses, income, and taxes. With industry-specific knowledge, our team is equipped to handle common bookkeeping issues that makeup artists face such as managing payments from various vendors, keeping track of expenses for beauty products, travel costs, and more.

When it comes to taxes, Bench works diligently to keep you in line with industry specific laws. The ever-changing beauty industry has its own rules and deductions - whether it’s for the depreciation of makeup kits, travel expenses for freelance work, or educational courses. Mistakes can be costly, but with our intuitive software paired with real, human bookkeepers, we can reduce the risk of an audit and make sure you take advantage of all possible deductions. Our expert team with their unparallel knowledge in the profession and industry laws, will help makeup artists manage their bookkeeping efficiently and make tax season a breeze. Let Bench handle your financials so you can focus on enhancing your client's beauty.

Simple, straightforward pricing for everything your business needs.

Get bookkeeping, tax prep, advisory, and filing with Bench's powerful, easy-to-use platform.

Choose Plan

Essential

billed annually

Premium

billed annually

Essential

billed monthly

Premium

billed monthly

Frequently Asked Questions

As a freelance makeup artist, there are several specific expenses you can claim on your tax return. These include but are not limited to:

- Costs of makeup and other supplies

- Education and training expenses related to your craft

- Rent or mortgage interest if you have a home studio

- Marketing and advertising costs

- Travel expenses for jobs at various locations

- Insurance premiums related to your business

- Office supplies and equipment

- Professional services such as accounting or legal fees

These expenses can often be fully or partially deductible, reducing your taxable income and potentially saving you money. Always consult with a tax professional to ensure you are claiming all eligible expenses.

Managing bookkeeping when purchasing new makeup and supplies for your business involves tracking all your expenses thoroughly. It is important to keep every receipt and record each purchase in your ledger or accounting software. All business-related purchases, including makeup and supplies, are considered business expenses and can be deducted from your taxable income. Ensuring you properly categorize these expenses allows for better financial management and more accurate tax filing. If you find this task overwhelming or time consuming, a bookkeeping service like Bench Accounting can handle it for you.

Yes, as a mobile makeup artist, you can deduct business-related travel expenses. Typically, this might include costs related to traveling to and from locations for client appointments, photoshoots, or other business-related events. These deductions can cover expenses such as fuel, vehicle maintenance, and public transportation costs. However, the rules around this can be complex, so it's recommended to consult with a professional bookkeeper to ensure you're accurately tracking and claiming these expenses. It's also important to keep detailed records of these expenses for tax purposes.

Nope! All bookkeeping is completed in-house.

Your bookkeeper will be your main point of contact, but at times you might hear from another member of your team. This is usually when your bookkeeper goes on vacation, is sick, or otherwise unavailable.

We handle the bookkeeping for you but sometimes we’ll need your input, especially at year-end. On average, expect to spend 15 minutes each month answering questions for your bookkeeper, or uploading supporting docs.

Bookkeeping Services for Makeup artists

Sign up for a Bench trial, and get one month free. If you decide to go with us, we’ll take bookkeeping off your plate—for good.

No credit card required. By clicking ‘Get Started’, I agree to Bench’s Terms & Privacy Policy.