Bookkeeping and Accounting for Investment Advisors

Searching for a bookkeeping solution for your investment advising firm? At Bench Accounting, we handle your books, so you get more time to concentrate on guiding your clients' investments. Give our service a try for free.

No credit card required. By clicking ‘Get Started’, I agree to Bench’s Terms & Privacy Policy.

How Bench works with investment advisors

Secure your bookkeeping, income tax prep, and filing with professionals—supported by one dynamic platform. Bench works seamlessly with investment advisors.

We get you set up

Our team devotes substantial time to comprehensively comprehend your investment advising firm, answer your inquiries, assist you in connecting your accounts, and demonstrate how Bench can streamline your operations.

We do your bookkeeping

Each month, your personal bookkeeper categorizes your investment advisory transactions and compiles comprehensive financial statements. If any additional information is required from you, they'll promptly reach out.

We deliver tax-ready financials

Our team of experts is well-versed with Investment advisory tax laws and will tailor their approach to your advisory firm's distinct requirements.

Here’s why investment advisors like you trust Bench with their bookkeeping and accounting

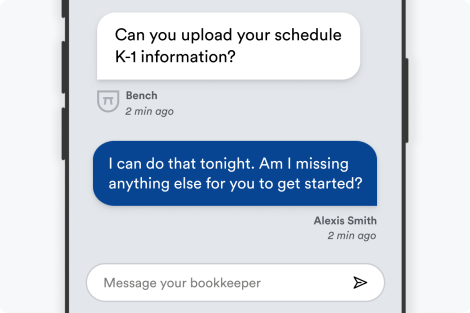

Get fast, unlimited support from our expert advisors

We constantly provide bookkeeping updates tailored for investment advisors. Have pressing financial inquiries that are urgently needed? Trust that we will respond to you within one business day or less.

Guaranteed accuracy in every detail

Bench's platform facilitates the automation of data inputs from most major providers, significantly reducing errors. Notably, we've partnered with financial service providers like Gusto, Stripe, Shopify, and Square — ensuring your financial management as an Investment Advisor is consistently accurate and reliable.

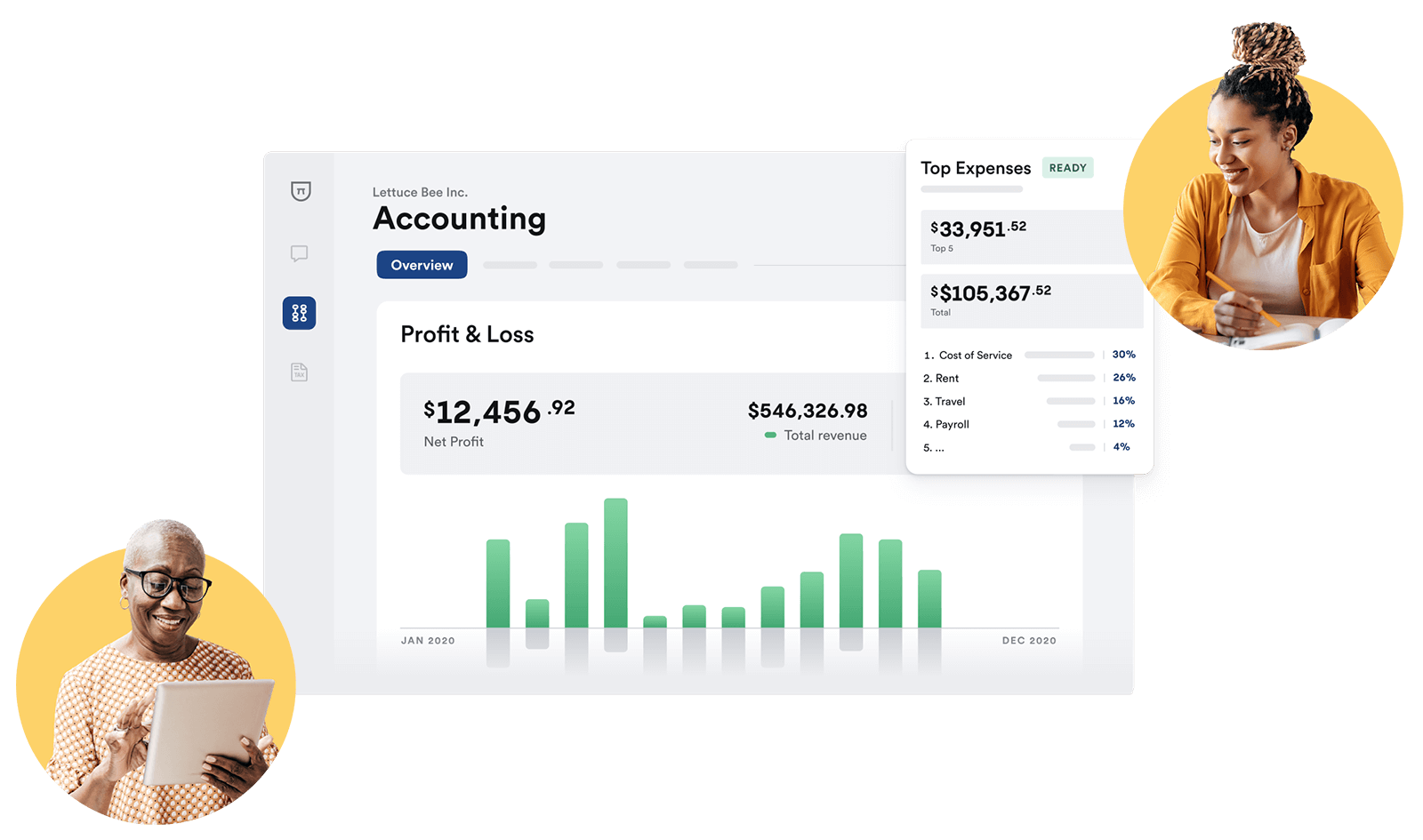

See where you’re spending. Make smart decisions

Say farewell to mountains of financial documents and labor-intensive manual audits—we streamline inputs straight from your connected accounts. Gain insights from one unified dashboard so you can effortlessly grasp the financial status of your investment advisory firm and make impactful strategic decisions.

Bench integrates with your favorite small business tools

We sync seamlessly with your financial accounts and tools to keep your books up-to-date and save you the time and effort of manually uploading documents.

Trusted by 25,000+ American small business owners

CHRIS RONZIO

DR. BUKKY KOLAWOLE

HEATHER SHOLL

We know bookkeeping for investment advisors

Navigating the financial world can be complex, and as an investment advisor, you know this better than anyone else. Yet, when it comes to handling your own bookkeeping, this complexity can add unnecessary stress and hours to your workload. Bench provides a seamless solution. Our expert team of bookkeepers is well-versed with specific regulations like SEC rules and ensures compliance with the Investment Advisors Act of 1940 and other industry-specific laws and taxes. This not only gives you peace of mind but also leaves you more time to focus on optimizing your clients' portfolios instead of grappling with numbers and tax forms.

Further, Bench's comprehensive online service covers an array of common bookkeeping issues in the investment sector. Whether it's handling complicated transactional data, accounting for capital gains and losses, or accurately classifying and recording various types of investments, our real, human bookkeepers paired with intuitive software make the process simpler and hassle-free. We also take care of tax filing, helping you claim the right deductions and ensuring your returns are accurate and on time, every time. With Bench, you get industry-specific, stress-free bookkeeping and tax services so you can focus on what you do best—providing sound investment advice.

Simple, straightforward pricing for everything your business needs.

Get bookkeeping, tax prep, advisory, and filing with Bench's powerful, easy-to-use platform.

Choose Plan

Essential

billed annually

Premium

billed annually

Essential

billed monthly

Premium

billed monthly

Frequently Asked Questions

At Bench Accounting, we offer a full suite of accounting services tailored to meet the needs of investment advisors. Our services include cash flow analysis, financial statement preparation, and tax planning and preparation. But beyond these standard accounting services, we also provide industry-specific features like investment tracking and financial forecasting. Our goal is to make sure your financial records are organized and up-to-date, so you can focus on advising your clients. Plus, our team stays current with financial regulations, ensuring your practice is compliant with all laws and guidelines.

Bench Accounting offers comprehensive bookkeeping services that are well-suited to managing multiple client portfolios and investment transactions. Our platform provides you with a team of experienced bookkeepers who work with you to understand your financial situation and client portfolios. We use sophisticated cloud-based software to track and record all transactions, providing you with monthly income statements and balance sheets.

You can also view your financial information at any time, providing an instant overview of each client portfolio. This real-time access allows you to make informed investment decisions, and ensure you are meeting your clients' objectives. Plus, at the end of the year, Bench provides a year-end financial package that contains everything you or your accountant would need to file income taxes.

With Bench, you can save time on bookkeeping, and focus on managing your clients' portfolios and finding valuable investment opportunities.

As an investment advisor, there are several tax considerations to keep in mind. These may include handling income from various investment types, managing capital gains taxation, keeping track of investment-related expenses for deductions, and understanding the implications of tax-loss harvesting. International investments may also introduce additional tax complexities.

Our bookkeeping services at Bench Accounting can greatly assist in managing these concerns. Our experts stay abreast with the latest tax laws and strategies relating to the investment industry. We meticulously track your income and expenses to ensure every report is accurate and up to date. Also, our team assists in preparing and filing your tax returns, ensuring that you leverage all the possible deductions to minimize your liabilities. Additionally, our services offer tax forecasting to help you understand your possible tax obligations and plan for them efficiently.

By partnering with us, you not only get a clearer financial picture but also obtain more time to focus on advising your clients and growing your business instead of worrying about bookkeeping and taxes.

Nope! All bookkeeping is completed in-house.

Your bookkeeper will be your main point of contact, but at times you might hear from another member of your team. This is usually when your bookkeeper goes on vacation, is sick, or otherwise unavailable.

We handle the bookkeeping for you but sometimes we’ll need your input, especially at year-end. On average, expect to spend 15 minutes each month answering questions for your bookkeeper, or uploading supporting docs.

Bookkeeping Services for Investment advisors

Sign up for a Bench trial, and get one month free. If you decide to go with us, we’ll take bookkeeping off your plate—for good.

No credit card required. By clicking ‘Get Started’, I agree to Bench’s Terms & Privacy Policy.