Bookkeeping and Accounting for Immigration Lawyers

Searching for a bookkeeper and accountant for your immigration law practice? We manage your books, so you can concentrate on helping your clients navigate the legal landscape. Try us for free.

No credit card required. By clicking ‘Get Started’, I agree to Bench’s Terms & Privacy Policy.

How Bench works with immigration lawyers

Manage your bookkeeping, income tax prep, and filing efficiently—handled by professionals—powered by one robust platform. Bench is tailored for immigration lawyers.

We get you set up

Our team takes the time to thoroughly comprehend your immigration law practice, answer any questions, assist you in connecting your accounts, and demonstrate how Bench can streamline your operation.

We do your bookkeeping

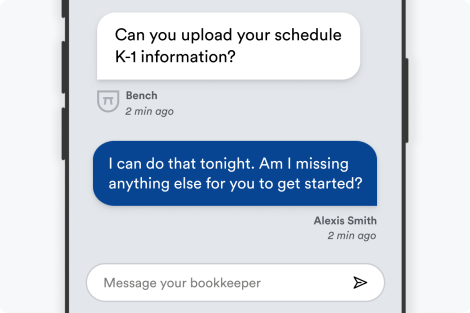

Each month, your dedicated bookkeeper sorts out your law firm transactions and prepares comprehensive financial reports for your Immigration Law Practice. If they require any additional details from you, they'll promptly contact you.

We deliver tax-ready financials

Our dedicated team is well-versed in tax regulations pertinent to immigration law practices and will tailor their methodology to meet the distinctive needs of your firm.

Here’s why immigration lawyers like you trust Bench with their bookkeeping and accounting

Get fast, unlimited support from our expert advisors

We'll consistently provide you with regular bookkeeping updates specifically tailored for immigration lawyers. Got urgent inquiries that demand immediate response? Rest assured, we will return your queries in one business day or less.

Guaranteed accuracy in every detail

Our platform empowers you to automate data inputs from most major providers, eliminating common errors. We form partnerships with key legal merchants like Clio, LawPay, LegalZoom, and Quickbooks, ensuring your financial records are consistently precise. Ideal for immigration lawyers, Bench Accounting simplifies bookkeeping to let you focus on what truly matters - your clients.

See where you’re spending. Make smart decisions

Bid farewell to mountains of client documents and labor-intensive manual bookkeeping—Bench Accounting streamlines inputs directly from connected accounts. Gain insights from one centralized dashboard allowing you to easily comprehend the financial status of your immigration law practice and make informed decisions.

Bench integrates with your favorite small business tools

We sync seamlessly with your financial accounts and tools to keep your books up-to-date and save you the time and effort of manually uploading documents.

Trusted by 25,000+ American small business owners

CHRIS RONZIO

DR. BUKKY KOLAWOLE

HEATHER SHOLL

We know bookkeeping for immigration lawyers

At Bench, we understand the intricate financial landscape that Immigration lawyers navigate daily. The often complex legal fees, client trust account management, and industry-specific tax laws require undivided attention and expertise which our team readily provides. Our real, human bookkeepers are conversant with the specific financial challenges your profession faces, like accommodating flexible fee arrangements, and abiding by the stringent accounting rules set by your state’s Bar Association. They meticulously track and categorize each expense, ensuring every penny allocated to client costs, legal research expenses and office overheads is correctly accounted.

What truly sets Bench apart, is our revolutionary pairing of intuitive software with your dedicated bookkeeping team. We streamline your bookkeeping process, rendering it stress-free and enabling you to focus your time and energy on your cases. Whether it's dealing with a client's I-9 employment verification forms, visa processing, or general consulting fees, our knowledgeable team is adept at managing your day-to-day bookkeeping, readying you for tax time. We navigate the labyrinth of profession-specific tax laws, deductions and credits, ensuring your business stays compliant and as profitable as possible. Bench has the specialized approach Immigration Lawyers need, freeing you from tedious financial management tasks, allowing you to focus on what truly matters - making a difference in your clients' lives.

Simple, straightforward pricing for everything your business needs.

Get bookkeeping, tax prep, advisory, and filing with Bench's powerful, easy-to-use platform.

Choose Plan

Essential

billed annually

Premium

billed annually

Essential

billed monthly

Premium

billed monthly

Frequently Asked Questions

Immigration lawyers, like all business owners, may be eligible for a range of tax deductions. Some of these may include:

- Home Office Expenses: If a section of your home is used exclusively and regularly for your law practice, you may be able to deduct a portion of your household expenses like rent, mortgage interest, utilities, and insurance.

- Professional Fees: Fees related to maintaining your professional license, membership to professional organizations, and continuing education can be deducted.

- Legal Research Costs: These could include subscription fees to legal research databases or journals, and the cost of books or reference materials.

- Travel Expenses: If your work requires you to travel, either locally or long-distance, you may be able to deduct those costs. This can include mileage on your personal vehicle used for business purposes, airfare, hotel accommodations, and even meals during your trip.

- Advertising and Marketing: Any costs associated with promoting your practice, such as website maintenance, online advertisements, and print ads, are typically tax-deductible.

Additionally, deductions can vary based on your specific business structure and other variables. Always consult with a professional tax preparer or accountant to ensure you're taking advantage of all applicable deductions.

For both bookkeeping and legal compliance, your immigration law practice should maintain a range of financial records such as:

- Income statements which show your practice's profits and losses

- Balance sheets which display your practice's financial position

- Cash flow statements that record the inflow and outflow of cash

- Client trust accounts to hold client funds separately from your firm's funds

- Tax returns and supporting documents

- Bank and credit card statements

- Receipts and invoices for expenses

- Employee payroll records

- Records of billable hours and invoiced legal fees

Ensure these records are organized and accurate to meet financial transparency requirements, satisfy audit compliance, and support legal and tax obligations. A professional bookkeeper experienced in legal industry accounting can greatly aid in maintaining these records.

Proper bookkeeping is critical for managing expenses and revenue in an immigration law firm. It ensures financial transactions are accurately recorded and categorized, making it easier to monitor the firm's cash flow. This means that you can easily identify where your expenses are high, if there are new revenue streams available, and if you need to modify any financial strategies. Bookkeeping also gives a clear picture of your firm's profitability, assisting in making informed business decisions. Additionally, bookkeeping plays a key role in ensuring the firm's compliance with tax laws and financial regulations, thereby avoiding penalties and possible legal issues.

Nope! All bookkeeping is completed in-house.

Your bookkeeper will be your main point of contact, but at times you might hear from another member of your team. This is usually when your bookkeeper goes on vacation, is sick, or otherwise unavailable.

We handle the bookkeeping for you but sometimes we’ll need your input, especially at year-end. On average, expect to spend 15 minutes each month answering questions for your bookkeeper, or uploading supporting docs.

Bookkeeping Services for Immigration Lawyers

Sign up for a Bench trial, and get one month free. If you decide to go with us, we’ll take bookkeeping off your plate—for good.

No credit card required. By clicking ‘Get Started’, I agree to Bench’s Terms & Privacy Policy.