Bookkeeping and Accounting for Health Food Stores

Looking for a bookkeeper and accountant for your health food store? We manage your books, so you get more time to focus on offering your customers the best organic options. Try us for free.

No credit card required. By clicking ‘Get Started’, I agree to Bench’s Terms & Privacy Policy.

How Bench works with health food stores

Keep your bookkeeping, income tax prep, and filing as healthy as your store's offering — professionally handled by experts—backed by one robust platform. Bench works seamlessly with health food stores.

We get you set up

Our team takes the time to thoroughly comprehend the unique needs of your health food store, answer any queries you may have, assist you in linking your accounts, and show you how Bench can streamline your business operations.

We do your bookkeeping

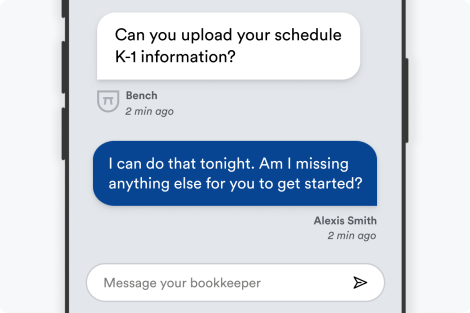

Every month, your bookkeeper categorizes your health food store transactions and compiles financial reports. If they require any additional information from you, they'll establish contact.

We deliver tax-ready financials

Our team of seasoned experts is well-versed in tax regulations relevant to health food stores and will tailor their methods to your business's specific requirements.

Here’s why health food stores like you trust Bench with their bookkeeping and accounting

Get fast, unlimited support from our expert advisors

With Bench Accounting, your health food store's bookkeeping is in good hands. We’ll provide regular updates on your financial status and all bookkeeping matters. Got urgent financial questions that need answering? Don't sweat it - we assure you a response in one business day or less.

Guaranteed accuracy in every detail

Bench Accounting lets you automate data from leading providers, helping to eliminate typical errors. We work hand-in-hand with health-focused merchants like Gusto, Stripe, Shopify, and Square — ensuring your health food store's finances are always precise and dependable.

See where you’re spending. Make smart decisions

Wave farewell to heaps of invoices and tedious manual record-keeping—we automate the data directly from your connected accounts. Garner valuable insights from a unified dashboard, enabling you to effortlessly comprehend your health food store's financial well-being and make informed strategic decisions.

Bench integrates with your favorite small business tools

We sync seamlessly with your financial accounts and tools to keep your books up-to-date and save you the time and effort of manually uploading documents.

Trusted by 25,000+ American small business owners

CHRIS RONZIO

DR. BUKKY KOLAWOLE

HEATHER SHOLL

We know bookkeeping for health food stores

At Bench, we understand how challenging bookkeeping can be for health food stores. With specific inventory management considerations, fluctuating market prices, unique sales tax specifics, and particular reporting requirements, the financial landscapes can be complex. With our innovative blend of intuitive software and real, human bookkeepers, health food store owners can effortlessly keep up with their financial responsibilities. We help deduce expenses such as cost of goods sold, shelf space rent, and expenses associated with perishable goods and the supply chain, which are all commonplace in this sector. You'll get a dedicated bookkeeping team who are proficient in your industry's specific laws and taxes, saving you from late tax penalties, inaccuracies or compliance issues.

Moreover, Bench can manage all your tax responsibilities, including sales tax remittance, end of year tax filing and provide tax advisory. With an explicit understanding of IRS regulations for health food stores, we ensure you claim every tax deduction you're eligible for. This includes industry-specific deductions such as organic certification costs, trade show expenses, or energy-efficient equipment. Our user-friendly dashboard presents real-time financial snapshots and detailed monthly reports, helping you track your profit margins and cash flow accurately. With this level of tailored bookkeeping support, health food business owners gain peace of mind, freeing them up to concentrate on growing their business. Our commitment is to make accounting a breeze for your health food store.

Simple, straightforward pricing for everything your business needs.

Get bookkeeping, tax prep, advisory, and filing with Bench's powerful, easy-to-use platform.

Choose Plan

Essential

billed annually

Premium

billed annually

Essential

billed monthly

Premium

billed monthly

Frequently Asked Questions

As a health food store owner, there are several specific tax deductions you may be able to claim. Below are a few examples:

- Cost of Goods Sold: You can deduct the cost of any products you've bought for resale.

- Business Expenses: This could include rent, utilities, advertising expenses, insurance, and more.

- Home Office Expenses: If you run your health food store from your home, you may be able to deduct a portion of your mortgage or rent as well as utilities.

- Vehicle Expenses: If you use your car for business purposes, you may be able to deduct mileage, maintenance, and other associated costs.

Please keep in mind this is not an exhaustive list and the deductions you are eligible for may depend on your specific circumstances. To ensure that you are taking full advantage of all the deductions available to you, it is recommended to consult with a professional bookkeeper.

Inventory management and accounting for a health food store can differ significantly from other businesses because of the unique nature of the products they sell. Health food stores often have a wide array of products with varying shelf lives, local and organic products, and specialized items. These factors can create complexities in inventory management.

From the accounting perspective, it's crucial to accurately track and manage costs related to purchasing, storing, and potentially disposing of inventory. Also, considering that many health foods are perishable, effective inventory management is critical in minimizing waste. Last, the ever-fluctuating prices of health foods, largely due to varying supply and demand, can introduce some additional challenges in accounting.

Therefore, while the principles of inventory management and accounting remain the same, the health food store needs to apply them with an understanding of its particular industry nuances.

For health food stores dealing with perishable goods, there are several key accounting considerations. Firstly, the cost of goods sold (COGS) would be a vital factor to consider. Since perishable goods have a limited shelf life, managing your inventory efficiently to minimize waste and loss would be crucial. Secondly, understanding the inventory shrinkage– the loss of products between point of purchase from the supplier and point of sale. This could be due to spoilage, theft, or errors in inventory management. Accurately accounting for shrinkage will greatly impact your store's profitability. Lastly, tax implications for donated or discounted perishable items that don't sell before their expiry should be considered. Always consult a professional accountant or bookkeeper who is well-versed in the specific accounting needs of a health food store to ensure your business finances are handled properly.

Nope! All bookkeeping is completed in-house.

Your bookkeeper will be your main point of contact, but at times you might hear from another member of your team. This is usually when your bookkeeper goes on vacation, is sick, or otherwise unavailable.

We handle the bookkeeping for you but sometimes we’ll need your input, especially at year-end. On average, expect to spend 15 minutes each month answering questions for your bookkeeper, or uploading supporting docs.

Bookkeeping Services for Health food stores

Sign up for a Bench trial, and get one month free. If you decide to go with us, we’ll take bookkeeping off your plate—for good.

No credit card required. By clicking ‘Get Started’, I agree to Bench’s Terms & Privacy Policy.