Bookkeeping and Accounting for Bakeries

Hung up on bookkeeping for your bakery? We handle your books, so you can dedicate more time to crafting delicious pastries. Try us for free.

No credit card required. By clicking ‘Get Started’, I agree to Bench’s Terms & Privacy Policy.

How Bench works with bakeries

Enjoy fresh peace of mind, while we handle your financial recipe. Get your bookkeeping, income tax prep, and filing diligently done by experts—all from one robust platform. Bench is the perfect ingredient for bakeries.

We get you set up

Our expert crew invests the necessary time to thoroughly comprehend your bakery business, respond to your queries, assist you in connecting your accounts, and demonstrate how Bench seamlessly integrates with your operations.

We do your bookkeeping

Each month, your dedicated bookkeeper sorts your bakery's transactions and prepares financial reports. If any additional information is needed from you, they won't hesitate to reach out.

We deliver tax-ready financials

Our team of experts is well-versed with the intricacies of bakery-related taxes across the US and will tailor their approach to your specific requirements.

Here’s why bakeries like you trust Bench with their bookkeeping and accounting

Get fast, unlimited support from our expert advisors

At Bench Accounting, we provide regular bookkeeping updates tailored to your bakery's unique needs. Got urgent inquiries that simply can't hold off? Rest assured, our top-notch team will respond to you in under one business day.

Guaranteed accuracy in every detail

At Bench Accounting, we understand that running a successful bakery involves more than just perfecting recipes, it also means managing finances accurately. Our platform allows you to automate data inputs from most major providers, eliminating common errors. We've partnered with renowned merchants like Gusto, Stripe, Shopify, and Square to ensure your bakery's finances are always spot-on. Craft delectable treats while we keep your books neat and tidy.

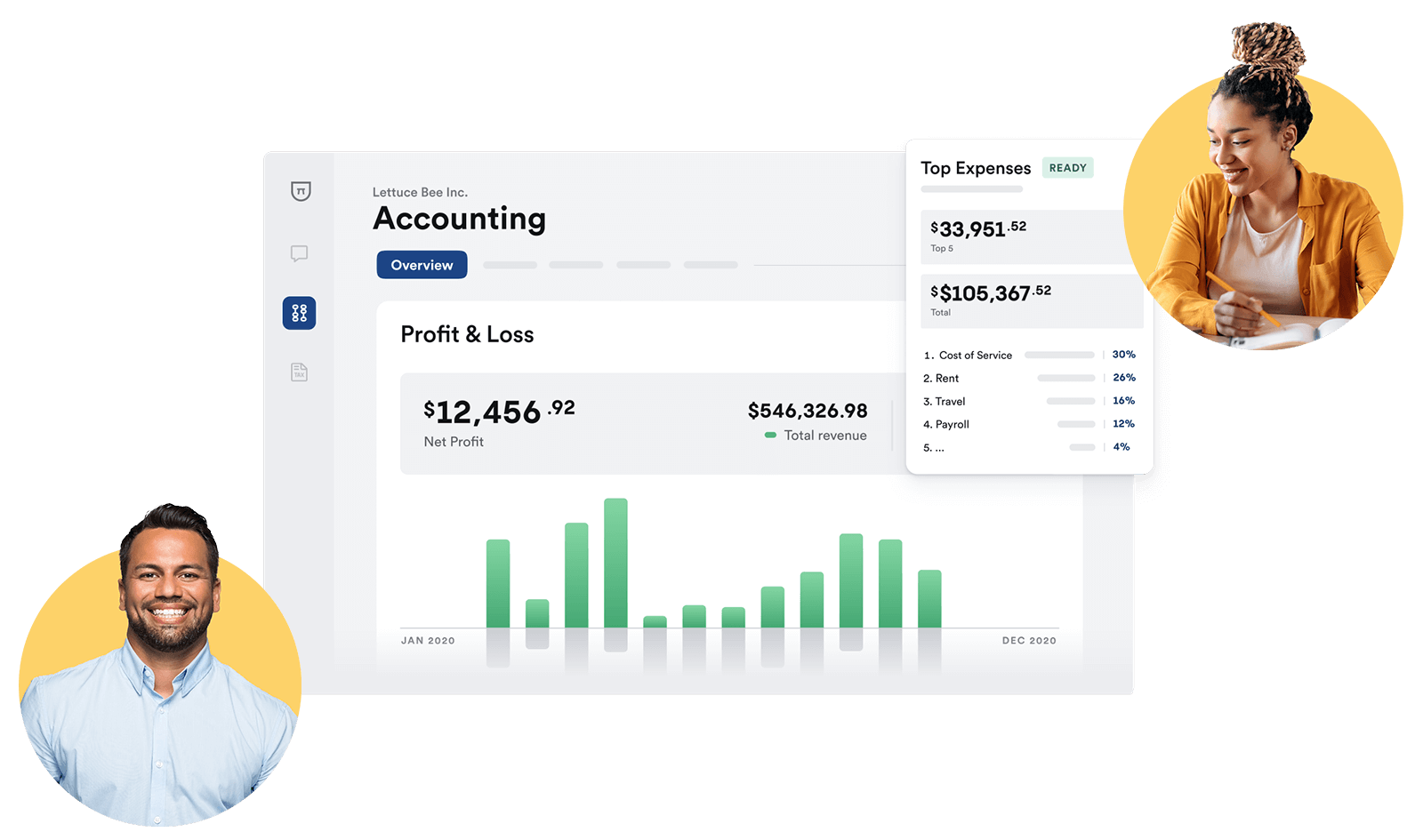

See where you’re spending. Make smart decisions

Wave goodbye to mountains of receipts and laborious manual record-keeping—we automate the data directly from your linked accounts. Gain insights from one central dashboard so you can effortlessly understand the financial wellbeing of your bakery and make strategic decisions.

Bench integrates with your favorite small business tools

We sync seamlessly with your financial accounts and tools to keep your books up-to-date and save you the time and effort of manually uploading documents.

Trusted by 25,000+ American small business owners

CHRIS RONZIO

DR. BUKKY KOLAWOLE

HEATHER SHOLL

We know bookkeeping for bakeries

In the bakery industry, Bench recognizes the unique challenges that come with managing finances. Dealing with the complex laws regarding food safety, fluctuations in commodity prices, and daily sales reporting can all have an immense impact on your books. Not to mention the sector-specific taxes and regulations you need to comply with, which may include state-specific sales taxes, food and hygiene levies, or local business licensing fees. With a deep understanding of the bakery business model, we know how to properly categorize your costs into cost of goods sold and overhead expenses, track and manage seasonal fluctuations, and how to keep track of daily sales and cash flow, giving you a crystal-clear insight into your financial health.

Bench's online bookkeeping services don't just automate the number crunching, but pair intuitive software with real, human bookkeepers. Our expert team is up to date with the latest tax laws, and they'll handle tax preparation and filing for you, ensuring that you don't miss out on bakery-specific tax benefits and deductions. For example, we help you track deductions on baking equipment and ingredients expenditures, and we handle sales tax filings if you sell your baked goods directly to customers. By taking this load off your shoulders, we help you focus on what you do best - running your bakery. At Bench, we’re changing bookkeeping for small business owners in the bakery industry, giving you more time for your craft.

Simple, straightforward pricing for everything your business needs.

Get bookkeeping, tax prep, advisory, and filing with Bench's powerful, easy-to-use platform.

Choose Plan

Essential

billed annually

Premium

billed annually

Essential

billed monthly

Premium

billed monthly

Frequently Asked Questions

As a bakery owner, you are entitled to claim certain specific expenses for tax purposes, these include:

- Cost of raw materials and supplies needed for baking

- Renting expenses for your shop space

- Salaries or wages paid to your staff

- Costs associated with marketing and advertising

- Depreciation of equipment used in your bakery

- Maintenance and repair costs

- Professional service costs, such as bookkeeping and tax preparation

- Utilities like electricity, water, and internet bills

- Insurance coverages specifically for your bakery business

It's critical to keep detailed records of these expenses throughout the tax year, as they can substantially reduce your taxable income. Always consult with a professional to ensure you're maximizing your deductions while staying compliant with tax laws.

Accounting for inventory in the baking industry can be a challenging task, especially considering perishable goods. However, it's essential to maintain accurate records to avoid overproduction and wastage. The primary accounting method used in this industry is the First In, First Out (FIFO) method. This method assumes that the first goods purchased are the first to be sold, which mirrors the production and sale process of bakeries, as products need to be sold before they reach their expiration date.

Moreover, because of the rapid turnover of goods, bakeries must regularly perform physical inventory counts to ensure that their records match what is actually available in terms of raw materials and finished goods. These counts can then be used to track waste, identify trends, monitor theft and control costs.

Lastly, in the baking industry, it is crucial to account not only for the cost of the raw materials but also for the indirect costs associated with production (like labor and overheads). These costs should be a part of the product costing, which helps in pricing decisions and determining profitability. A reliable bookkeeper can help to manage these elements efficiently.

A solid bookkeeping system that is ideal for managing your bakery business's daily cash sales and credits includes cloud-based accounting software such as Benchh. These platforms provide features for tracking sales, monitoring expenses, managing inventory, and handling credits. Coupled with a professional bookkeeper who is knowledgeable about the bakery industry, these systems can offer invaluable insights into your business's financial health.

Nope! All bookkeeping is completed in-house.

Your bookkeeper will be your main point of contact, but at times you might hear from another member of your team. This is usually when your bookkeeper goes on vacation, is sick, or otherwise unavailable.

We handle the bookkeeping for you but sometimes we’ll need your input, especially at year-end. On average, expect to spend 15 minutes each month answering questions for your bookkeeper, or uploading supporting docs.

Bookkeeping Services for Bakeries

Sign up for a Bench trial, and get one month free. If you decide to go with us, we’ll take bookkeeping off your plate—for good.

No credit card required. By clicking ‘Get Started’, I agree to Bench’s Terms & Privacy Policy.