Which auto expenses are deductible on your business taxes?

While owning and operating a car comes with plenty of costs, not all of them are deductible—at least, not in every case. The amount you can deduct will also depend on how much you use your car for business as opposed to personal purposes.

If the vehicle is used solely for business purposes, then you can deduct the entire cost of its ownership, use, and maintenance. If you use the car for both business and personal use, then you can deduct the costs associated with its business use. So, if you use your car 25% of the time for business, you can deduct 25% of the total costs of its use (or 25% of the miles you drove in a year, if you’re using the standard mileage rate).

Here are the expenses that are eligible for tax deductions, according to the IRS:

- Mileage. The IRS publishes a standard mileage rate each year which you can use to calculate your mileage deduction—just multiply the rate by the number of miles you drove for business purposes.

Note that commuting from your home to an office and back is not deductible; that is classified as a personal expense. Additionally, if you use the standard mileage rate deduction, you won’t be able to deduct other expenses associated with your vehicle, including depreciation, gas or fuel, registration and license fees, etc. You can, however, deduct the cost of parking and tolls.

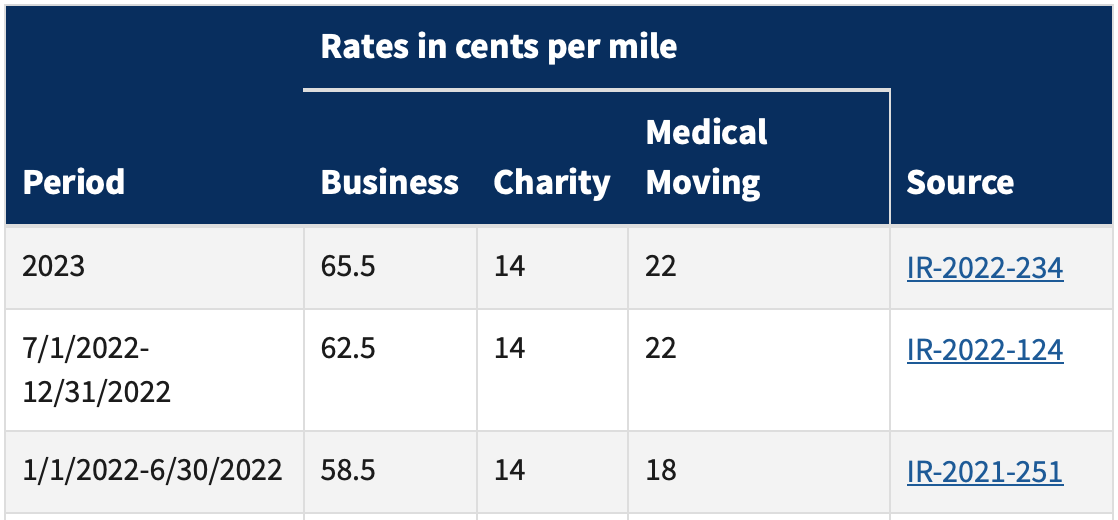

For 2023, the mileage rate is 65.5 cents per mile for businesses, and 14 cents per mile for charities. The table below shows the rates for 2022 as well as 2023:

- Depreciation. Depreciation refers to the cost of regular wear and tear on your car, and can be calculated using the Modified Accelerated Cost Recovery System (MACRS).

If you’re calculating your auto-related deductions using the actual expense method, meaning you keep track of your actual expenses (with receipts and documentation), you’ll calculate your depreciation as an actual expense.

- Gas and fuel costs. Any gasoline or fuel costs associated with business use of your car can be deducted.

- Lease payments. If you lease your vehicle, you can deduct a percentage of the lease payments. This percentage would be equal to the percentage of total miles that you drove for business.

- Loan interest payments. Similarly, you can deduct a percentage of the interest you pay on your car loan if you own the car.

- Administrative fees for licenses, registration, etc. Registration renewals, license renewals, and other administrative fees are deductible.

- Maintenance and repairs. Expenses related to maintaining and repairing your vehicle are deductible. This includes oil changes, tire rotations, brake repairs, and other necessary maintenance (remember, only the portion of it that applies to business use of the vehicle).

- Insurance premiums. If your auto insurance premium covers business use of your vehicle, you can deduct a portion of those payments.

How Bench can help

Figuring out which vehicle-related expenses are eligible and how to report them can be time-consuming, which is why many business owners choose to use bookkeeping and tax services like Bench. If you work with Bench, all you need to do is track your miles and expenses—our bookkeepers and tax advisors can take care of the rest.

Two deduction method options: standard mileage rate vs. actual expenses

You’ve got two options for how to deduct eligible car-related expenses: the standard mileage rate method, or actual expenses method. This is similar to the choice between taking the standard deduction or itemizing.

If you choose the standard mileage method, then you’ll calculate your deduction by multiplying the number of miles you drove for business that tax year by the standard mileage rate. You can also deduct the cost of tolls and parking fees, as well as the percentage of personal property taxes for your vehicle that are related to its business use.

If you use the actual expenses method, you won’t deduct mileage, but you will deduct your other eligible costs.

Strategies for maximizing your vehicle-related deductions

Keep detailed records

Maintaining meticulous records is vital to maximizing your car deductions. This includes documenting all your auto-related expenses, mileage, and the purpose of each trip. Best practices for record-keeping include:

- Maintain a dedicated mileage log for business use. Record the date, starting and ending locations, mileage, and purpose of the trip for each business-related journey.

- Keep copies of all receipts for fuel, maintenance, repairs, insurance, and other auto-related expenses. Note the business-related portions where applicable.

- Use a smartphone app or digital tool designed for expense tracking and mileage logging to make record-keeping more convenient and accurate.

Choose the right deduction method

Choosing the right method, standard mileage or actual expenses, can significantly impact your deductions.

Standard mileage rate

The standard mileage rate is a simplified method that allows you to deduct a fixed amount for each business mile driven. Using the standard mileage rate is straightforward and requires less record-keeping; however, it might not provide the highest deduction if your actual expenses are significantly higher than the standard rate. If you have the documentation, it’s a good idea to evaluate both methods to determine which one is more advantageous for your specific situation.

Actual expenses method

The actual expenses method involves itemizing all of your vehicle-related costs, including depreciation, fuel, maintenance, insurance, and other expenses. To use this method, you need to keep detailed records of all expenses related to your vehicle.

While the actual expenses method can result in higher deductions if your costs are substantial, it does require more documentation and record-keeping. You'll also need to calculate the percentage of your vehicle's business use accurately.

Before selecting a deduction method, it’s best to consult with a tax professional to determine which one is best suited to your unique circumstances. If you’re able to, you can also calculate your deductions using both methods, and choose the one that results in a higher amount.

Consider taking a Section 179 deduction

If you’ve just purchased any type of vehicle to use for business purposes, and you’re using it for business more than 50 percent of the time, you can take something called a Section 179 deduction. This means that instead of depreciating the vehicle over time, you can deduct the full eligible amount of the purchase in a single year, lowering your tax liability.

This can be a helpful strategy if you believe you will owe money on your tax bill, and want to reduce your taxable income for the year.

Real world examples: how vehicle-related tax deductions can decrease a business’s tax bill

Let’s take a look at how these deductions can actually affect your business’s tax bill.

Example 1: A delivery services business

Imagine a small delivery services business that uses a van primarily for business purposes. In the 2023 tax year, they purchase a new van for $30,000. By leveraging Section 179 deductions and bonus depreciation, they can deduct the entire $30,000 cost in the first year. This substantial deduction reduces their taxable income, resulting in lower tax liability. Without these deductions, they would have to depreciate the van's cost over several years, which would not provide the same immediate tax relief.

Example 2: A consulting firm

A consulting firm's owner uses their personal vehicle for business meetings and client visits. In the 2023 tax year, they log 10,000 business miles. Using the standard mileage rate of 58.5 cents per mile, they can deduct $5,850 (10,000 miles x $0.585). Without this deduction, their taxable income would be higher, leading to a larger tax bill.

Example 3: A construction contractor

A contractor operates a small construction business and uses a truck for both business and personal purposes. The contractor keeps meticulous records of her vehicle expenses, including fuel, maintenance, and insurance. These records help her determine that 70 percent of their vehicle use is for business, and she decides to use the actual expenses method for deductions. The annual vehicle expenses amount to $6,000, so the contractor can deduct $4,200 (70 percent of $6,000) as business expenses, reducing her taxable income accordingly.

Vehicle expense documentation strategies

If you plan on deducting vehicle-related costs, whether using the standard mileage rate or actual expenses, you’ll need a strategy for record-keeping.

One of the easiest ways to keep track of vehicle-related expenses is to use a mileage and expense tracking app. Many of these not only allow you to log miles and the trip’s purpose, but also generate tax-compliant documentation. Some can integrate with your accounting or bookkeeping software, too.

If you don’t have an app or don’t want to use one, keep a notebook and pen in your car at all times to write down your mileage for each trip. The tricky part about this is you’ll need to track every trip you take, not just the business ones—this way, you’ll be able to tell how much of your driving is for business rather than personal purposes.

You’ll also need to track all associated expenses for gas, maintenance, repairs, insurance, and more if you plan to use the actual expenses deduction method. If you do decide to use this method, an app designed for tracking expenses and mileage is highly recommended—otherwise, keeping track of paper receipts and miles for a full tax year can lead to hours spent sorting through papers and trying to remember which trips were for what.